For generations, property has been a dependable strategy for building and preserving wealth. It is a method built on acquiring real estate not to live in, but to generate income – whether through rental payments, a profitable resale, or long-term capital appreciation.

At its core, success in property investment boils down to several key benefits: creating a steady rental income, building personal net worth as property values rise, and adding a solid, tangible asset to your financial portfolio.

Your First Step into Property Investment

This guide is designed to provide clarity and demonstrate exactly how to begin, even as a complete novice. The path from a curious beginner to a confident investor requires careful planning and a clear, data-driven strategy.

A common question is: "Is property still a sound investment?" In a world of volatile stocks and digital currencies, the answer lies in its physical nature. Unlike a line on a screen, property is a real asset, offering many investors a tangible sense of security. It provides two powerful streams of return: regular cash flow from tenants and the potential for significant capital growth over time.

Why Property Investment Endures

History demonstrates that property is a remarkably resilient asset class. Markets fluctuate, but the fundamental human need for housing is constant. In the UK, for instance, despite short-term dips, long-term data from the Office for National Statistics (ONS) consistently shows an upward trend in house prices. This underlying demand solidifies its position as a reliable long-term asset.

Prudent property investment is not about chasing rapid profits or succumbing to market hype. It is about making calm, informed decisions based on robust analysis. The rewards for this approach are significant:

- Consistent Passive Income: Rental payments cover mortgage obligations and other costs, creating a reliable monthly income stream.

- Capital Appreciation: Over the long term, property values tend to increase, steadily building personal wealth.

- Portfolio Diversification: Real estate often moves independently of the stock market, providing valuable balance to an investment portfolio.

- Inflation Hedge: As the cost of living rises, so do rents and property values, helping to protect your capital's purchasing power.

This guide provides a clear roadmap. We will cover everything from understanding key metrics like rental yield to navigating the purchase process in different countries. Our objective is to equip you with the knowledge required for sound investment decisions.

To begin on a solid footing, it is helpful to have a foundational understanding of the market. To explore various strategies and insights, you can find a wide range of articles on property investment on our website.

Understanding the Language of Property Investment

Before you can analyse an opportunity, you must understand the language of property. Successful investing is not about mastering complex financial jargon; it is about a firm grasp of core concepts that allow you to accurately assess a potential deal.

There are several paths a new investor can take, each with distinct objectives and timeframes. The most common route is buy-to-let, where the primary aim is to generate a steady monthly income from tenants. This is a long-term strategy, focused on reliable cash flow and the gradual increase in the property's value.

Another popular approach is property flipping. This is a much shorter-term strategy. You acquire a property, add value through renovations, and aim to sell it for a profit, typically within six to twelve months. It can deliver faster returns but also carries higher risks and requires more hands-on involvement.

Key Property Investment Strategies Compared

To determine the right path for you, it is crucial to understand the fundamental differences between strategies. Each demands a unique approach to financing, market selection, and risk management. Consider your financial goals, available capital, and the time you can realistically commit.

| Strategy | Primary Goal | Typical Time Horizon | Key Metric | Best Suited For |

|---|---|---|---|---|

| Buy-to-Let | Consistent monthly rental income and long-term capital growth. | 5+ years | Rental Yield | Investors seeking steady, passive income and wealth building. |

| Property Flipping | Quick profit from renovating and reselling a property. | 6-18 months | Return on Investment (ROI) | Investors with renovation expertise and higher risk tolerance. |

| Holiday Lets | Maximising rental income from short-term tourist bookings. | Varies | Occupancy Rate & Nightly Rate | Investors in tourist hotspots willing to manage frequent turnovers. |

Understanding these distinctions is the first practical step toward building a focused and effective investment plan.

Calculating Rental Yield Correctly

For any buy-to-let investor, rental yield is the most important metric. It measures your annual rental income as a percentage of the property’s value, allowing for like-for-like comparisons between different opportunities. You will encounter two types: gross and net.

Gross Yield is a preliminary calculation:(Annual Rent / Property Purchase Price) x 100

For example, a £250,000 property generating £1,200 per month in rent has an annual rental income of £14,400. The gross yield is 5.76%. This is a quick gauge of potential but does not present the full picture.

Net Yield provides a more accurate reflection of profitability because it accounts for all operating costs. The formula is:((Annual Rent - Annual Costs) / Total Investment Cost) x 100

'Annual Costs' includes everything from insurance and maintenance to letting agent fees and void periods. 'Total Investment Cost' comprises the purchase price plus all transaction fees, such as Stamp Duty and legal costs. This figure reveals your true cash flow.

A brief look at the UK market illustrates why this matters. Recent ONS data shows private rental prices have risen, while house price growth has moderated. This dynamic underscores the potential for strong rental yields, explaining why buy-to-let remains a popular entry point for investors.

Key Takeaway: Always prioritise Net Yield over Gross Yield. A property might have an attractive gross yield, but if its operating costs are high, it can easily become unprofitable. Accurate calculations from the outset prevent costly mistakes.

Measuring True Profit: Return on Investment

While yield focuses on rental income, Return on Investment (ROI) measures the total profitability of an investment against the actual cash you have committed. This is the ultimate metric for judging the success of your capital deployment, especially for strategies like flipping.

The formula is straightforward:(Net Profit / Total Cash Invested) x 100

Imagine you invested £70,000 of your own capital (your deposit plus all purchasing costs) to acquire a property. After one year, your net profit from rental income and value appreciation is £7,000. Your ROI would be a healthy 10%.

ROI is powerful because it focuses on your capital efficiency—how effectively your own money is working for you. For a deeper analysis of the figures, review our guide on how to calculate return on investment (ROI) for real estate. Mastering these metrics is non-negotiable for serious property investors.

How to Finance Your First Property Investment

Securing finance for a first property is often the largest hurdle for new investors, but it is manageable with careful planning. Most beginners will require a lender, which in the investment property sector means understanding a specific loan type: the buy-to-let mortgage.

A buy-to-let mortgage differs from a residential mortgage. Lenders are not just assessing your personal income; their primary focus is the property’s ability to generate rent. Affordability checks are based on the expected rental income, which typically must cover the mortgage payments by at least 125% to 145%.

Understanding Buy-to-Let Mortgages

The first noticeable difference is the deposit. While a residential mortgage might be secured with a 5-10% deposit, lenders view investment properties as a higher risk. This means a larger initial cash contribution is required.

For a buy-to-let mortgage, most lenders will require a minimum deposit of 25% of the property’s value. On a £200,000 property, that equates to £50,000 in cash for the deposit alone, before other costs are considered.

You will also find that these mortgages typically have slightly higher interest rates and larger arrangement fees than standard residential loans. They are often structured as interest-only, meaning your monthly payment covers only the interest on the loan, not the principal. This keeps monthly outgoings low and maximises cash flow, with the expectation that the loan is repaid in full when the property is eventually sold.

Alternative Funding Strategies

While a buy-to-let mortgage is the most conventional route, it is not the only one. Astute investors often use creative funding methods to enter the market or scale their portfolios more quickly.

Here are a few proven alternatives:

- Leveraging Equity From Your Home: If you have built significant equity in your own home, you can remortgage to release some of that capital. This provides a tax-free lump sum that can serve as a powerful deposit for an investment property.

- Forming a Joint Venture (JV): A JV is a formal partnership. You might find a partner with capital but not the time or expertise to find and manage a deal. You source the property and manage the project, they provide the funds, and you both share the profits according to a pre-agreed structure.

- Strategic Cash Purchases: While less common for beginners, buying with cash makes you a highly attractive buyer. It eliminates all mortgage costs and provides significant negotiating power to secure a better price.

Understanding your financial options is critical. For a more detailed exploration, you can learn more about financing investment property in our comprehensive guide.

Preparing Your Mortgage Application

Whether you are investing in the UK or considering markets like Spain or Portugal, a well-prepared mortgage application is essential. Lenders seek financially responsible applicants who are organised and professional.

Begin by putting your finances in order:

- Strengthen Your Credit Score: Reduce personal debts, ensure you are registered on the electoral roll, and check your credit file for any errors with agencies like Experian or Equifax. A strong credit history makes you a more attractive borrower.

- Organise Your Paperwork: Lenders will request several months of bank statements, payslips, and proof of your deposit's source. Having this information ready demonstrates professionalism and expedites the process.

- Create a Simple Business Plan: This does not need to be an extensive document. A clear outline of the property details, expected rental income (supported by local comparables), and projected costs is sufficient. It proves to the lender that you have conducted your due diligence and are treating the investment seriously.

Taking these steps demonstrates to a lender that you are a credible, low-risk investment partner.

How to Find the Right Investment Market

Choosing where to invest is arguably the single most important decision you will make. A correct choice can lead to strong rental demand and healthy capital growth for years. An incorrect one could result in costly vacancies and a stagnant asset.

Success is not about chasing media-hyped hotspots; it is about learning to identify fundamentally sound markets using clear, data-driven indicators. A strong investment market is like a healthy ecosystem—it has multiple drivers working in synergy to create sustainable growth. Your task is to learn how to recognise these signs.

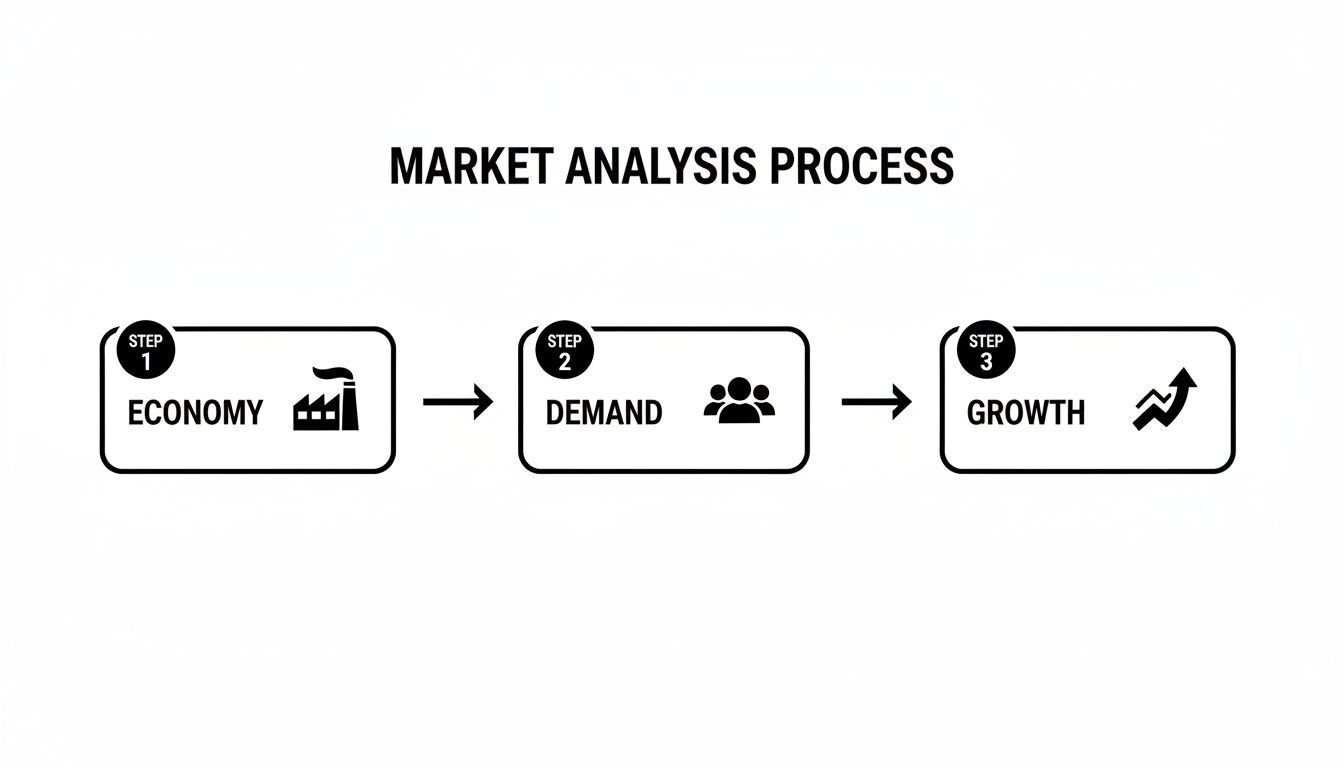

Analysing Economic Drivers

A property market is underpinned by its local economy. A thriving economy creates jobs, attracts new residents, and consequently drives up demand for housing. You do not need an economics degree to understand this; you just need to know what to look for.

Begin by investigating three core areas:

- Job Growth: Look for announcements of new corporate headquarters, business parks, or major employers relocating to an area. Government reports detailing a surge in local employment are a significant positive indicator for investors.

- Population Growth: Is the city or town growing? Local authorities or national statistics bodies, such as the ONS in the UK, publish this data. Consistent population growth is one of the clearest indicators of rising housing demand.

- Infrastructure Investment: Large-scale projects like new transport links, motorway upgrades, or hospital expansions act as magnets for growth. They make an area more desirable, improve connectivity, and can boost property values significantly.

Comparing Established vs. Emerging Markets

Your research will inevitably lead to a classic investor dilemma: do you invest in a stable, established market or take a calculated risk on an emerging one? Each presents a different risk-and-reward profile.

- Established Markets (e.g., London, Paris, New York): These cities offer stability, deep rental markets, and a long track record of appreciation. However, entry costs are extremely high, and rental yields are often compressed, typically in the 3-5% range. The risk is lower, but so is the immediate cash flow.

- Emerging Markets (e.g., Cities in Portugal, Poland, or Southeast Asia): These locations can deliver much higher rental yields—often 6-10% or more—and have far greater potential for rapid capital growth. The trade-off is higher risk, which could include currency volatility, reduced market transparency, or political uncertainty.

Investor Takeaway: For beginners, an excellent starting point is often an established market but in a high-growth "ripple" area—a well-connected suburb just outside a major city centre. This strategy allows you to benefit from the core city's economic strength but with a more accessible entry price and better rental yields.

Researching Local Rental Demand

Once you have identified a promising city or region, it is time to conduct micro-level analysis. Macro trends are important, but what truly matters is whether you can secure a reliable tenant quickly. This requires granular research into local rental demand and tenant demographics.

First, examine vacancy rates—the percentage of empty rental properties in an area. A rate below 3-4% signals strong demand, meaning your property is unlikely to remain vacant for long. Local letting agents are often the best source for this on-the-ground information.

Next, define your target tenant. Is the property near a university requiring student housing? A hospital with medical professionals? A business district attracting young professionals? Knowing your tenant profile helps you select the right type of property, ensuring it meets local demand. This detailed research is critical, and learning how to find undervalued properties in hot markets can provide a significant competitive advantage.

A methodical research process removes emotion and guesswork from your decision-making. By focusing on these core pillars—economic health, market type, and local rental demand—you build a repeatable system for finding investment-grade locations anywhere in the world.

Navigating the Property Purchase Process

You have found a promising market and identified a property that meets your criteria. The next stage is converting your research into a tangible asset.

The journey from finding a property to holding the keys involves a series of structured steps designed to protect both you and your investment. For any beginner, understanding this process is essential. It is often filled with legal terminology and potential pitfalls that can easily ensnare the unprepared.

While specifics vary between countries, the core principles of due diligence, negotiation, and legal transfer are universal.

This illustrates that a prudent purchase is always built upon a solid foundation of research into the area’s economy and rental demand.

Conducting Thorough Due diligence

Due diligence is the critical investigation you undertake before legally committing to a purchase. It is your single best defence against costly future surprises. Neglecting this step is one of the biggest mistakes a new investor can make.

Two professional services are central to this process: the property survey and the solicitor.

- The Property Survey: A chartered surveyor inspects the property’s physical condition, looking for structural defects, damp, subsidence, or other issues not apparent during a brief viewing. A comprehensive survey can uncover problems that might cost thousands to rectify, giving you powerful leverage to renegotiate the price—or withdraw from a poor investment.

- The Solicitor's Role: A specialist property solicitor (or conveyancer) handles all legal aspects. They conduct searches with local authorities to check for planning disputes, upcoming developments, or any legal restrictions tied to the property. Their role is to ensure the seller has the legal right to sell and that you receive a clean, undisputed title.

The Key Stages of a Property Purchase

While terminology may differ globally, the purchase process generally follows a clear sequence. In the UK, for example, the journey from making an offer to completion has several distinct milestones.

- Making an Offer: You submit a formal offer to the seller, typically via the estate agent. It is prudent to make this offer "subject to survey and contract," which means it is not legally binding until formal contracts are signed.

- Negotiation: The seller may accept, reject, or propose a counter-offer. Your market research is invaluable here, as you can justify your offer with hard data on recent sales of comparable local properties.

- Offer Accepted and Legal Work Begins: Once your offer is accepted, both you and the seller instruct your respective solicitors. At this point, you should book the property survey, and your solicitor will commence their legal checks.

- Exchange of Contracts: This is the point of legal commitment. You and the seller sign identical contracts, and you pay the deposit (typically 10% of the purchase price). Once contracts are exchanged, the deal is legally binding.

- Completion: On a pre-agreed date, the remaining funds are transferred to the seller’s solicitor, and legal ownership passes to you. You can now collect the keys to your new investment property.

Key Takeaway: The period between your offer being accepted and the exchange of contracts is your critical window for due diligence. Use this time effectively to ensure the property is legally and physically sound before you are financially committed.

Accounting for Hidden Costs

A common oversight for new investors is underestimating the total cost of acquisition. The agreed purchase price is only one component. Several other fees must be factored into your budget.

These transaction costs typically add an extra 5-8% on top of the purchase price and include:

- Stamp Duty Land Tax (SDLT): This is a government tax on property purchases in the UK. The rates are tiered based on the property’s value and are higher for second homes and investment properties. Always consult official sources like Gov.uk for the latest bands.

- Legal Fees: The cost for your solicitor's services, which also covers searches and land registry fees.

- Survey Fees: The cost of hiring a surveyor, which varies depending on the level of detail required in the report.

- Mortgage Fees: Lenders often charge arrangement fees for buy-to-let mortgages. These can sometimes be added to the loan or may require upfront payment.

Managing Your Property and Mitigating Risk

Acquiring the keys is a significant milestone, but your work as an investor is just beginning. Effective management and intelligent risk mitigation are what separate a profitable asset from a costly liability. It is time to operate your investment like a business to protect its value and ensure consistent cash flow.

One of the first decisions you will face, particularly as an overseas investor, is whether to manage the property yourself or hire a professional letting agent. Self-management can save money but demands considerable time and local knowledge. For most international investors, a good agent is not a luxury—it is a necessity.

Self-Management vs. Professional Letting Agents

The correct choice depends on your location, experience, and the time you can realistically dedicate to the task. Both approaches have distinct advantages and disadvantages.

-

Self-Management: This route offers complete control and saves on agent fees, which typically range from 8-12% of the monthly rent. The drawback is that you are responsible for everything: advertising the property, screening tenants, handling late-night emergency calls, and navigating complex tenancy laws. This is a formidable challenge if you are not in the same city, let alone the same country.

-

Hiring a Letting Agent: An agent manages the day-to-day operations for you—from finding and vetting tenants to collecting rent and organising maintenance. Their local expertise is invaluable for ensuring compliance with safety regulations, such as gas safety certificates in the UK, or handling potential disputes. The fee is a business expense that buys professional oversight and peace of mind.

For anyone new to property investment for beginners, the value a good letting agent provides almost always outweighs the cost, particularly for those investing from abroad. They are your professional representatives on the ground.

Building Your Risk Management Toolkit

Prudent investors do not rely on hope; they plan for contingencies. A robust risk management strategy is your shield, protecting your capital and income stream from unforeseen events.

Your financial safety net should have several key layers. These strategies help you absorb shocks—such as an unexpected repair bill or an economic downturn—without derailing your investment goals.

- Landlord Insurance: Standard home insurance is insufficient. You need specialist landlord insurance that covers property damage, loss of rent, and public liability in case a tenant is injured at your property.

- Budget for Void Periods: It is unrealistic to expect 100% occupancy. A conservative approach is to budget for at least one month of lost rent each year to cover the gaps between tenancies.

- Create a Maintenance Fund: Set aside 1-2% of the property’s value annually for repairs and general upkeep. A major issue like a faulty boiler or a leaking roof can easily negate months of profit if you are unprepared.

Furthermore, you must have a firm grasp of your legal and financial obligations. Managing tax responsibilities is non-negotiable. Our in-depth guide can help you understand property taxes for your investment, ensuring you remain compliant and financially prepared. By addressing these factors early, you transform a simple property purchase into a resilient, professional business.

Common Questions from New Property Investors

When starting out, it is natural to have numerous questions. Obtaining clear answers is what separates a confident beginning from a hesitant one. Here are the most common queries from new investors, answered directly.

How Much Capital Do I Need to Start?

This is typically the first question for any prospective investor. While the exact figure varies by market, the fundamentals are consistent: you need a substantial amount of liquid capital.

In the UK, a typical buy-to-let mortgage requires a 25% deposit. However, that is only the starting point. You must also cover transaction costs. A prudent estimate is to budget an additional 5-8% of the property's price for Stamp Duty, legal fees, and surveys.

Therefore, for a £200,000 property, you would likely need between £60,000 and £66,000 in available capital before acquisition.

Is It Better to Invest Domestically or Abroad?

Investing in your home market is often the most straightforward path. You are already familiar with the legal system, the culture, and local tenant expectations. It is a sensible way to learn the fundamentals of property investment without adding layers of complexity.

However, international markets can unlock exceptional opportunities, from higher rental yields to valuable portfolio diversification. This approach introduces new considerations, such as different tax regimes, currency fluctuations, and foreign ownership regulations. International success is achievable but requires more thorough research and, crucially, a reliable on-the-ground team.

What Is the Biggest Mistake New Investors Make?

Without question, the single most significant—and costly—mistake is insufficient due diligence. This error commonly manifests in several ways:

- Underestimating Costs: Failing to budget accurately for maintenance, void periods, and management fees.

- Poor Market Research: Not properly analysing local rental demand or understanding the target tenant demographic.

- Neglecting Professional Advice: Attempting to save money by avoiding independent legal advice or a comprehensive property survey.

A successful property investment is always built on careful, conservative calculations—not emotion. Always verify your numbers, seek professional advice, and prioritise robust research over market hype to protect your capital and secure long-term returns.

Ready to find your next investment opportunity? World Property Investor provides the global insights and data-driven analysis you need to invest with confidence. Explore our in-depth market guides at https://www.worldpropertyinvestor.com.