Embarking on a property investment journey is a proven method for building long-term wealth, but success is contingent on establishing the correct foundations. Before reviewing listings, you must have a clear understanding of your financial objectives, an honest assessment of your budget, and a robust strategy. The initial question to address is fundamental: are you pursuing immediate rental income or aiming for long-term capital appreciation?

Building Your Global Investment Foundation

Your strategy begins with your personal financial situation and risk tolerance. Are you attracted to the higher rental yields often found in emerging markets, or does the stability and steady capital growth of an established economy like Germany or the UK present a more suitable option?

A common error is attempting to achieve both high yield and high growth with a single property. An investor targeting high yield might focus on a university city where a constant stream of students minimises void periods, even if house price growth is modest. Conversely, an investor focused on capital growth may accept a lower initial yield on a flat in a major global city, relying on strong long-term economic prospects to drive its value upwards.

For a deeper analysis of different investment approaches, you can find extensive information in our broader guides on property investment.

Arrange Your Finances

Before commencing your search, a thorough financial audit is essential. This process extends beyond determining your deposit; it requires a realistic budget that encompasses all associated acquisition costs, which can significantly inflate your initial outlay.

Ensure you account for the following:

- Stamp Duty or Property Transfer Tax: This varies substantially between countries. In England, for instance, Stamp Duty Land Tax (SDLT) can add thousands of pounds to a purchase and is payable upfront.

- Legal and Conveyancing Fees: Engaging a solicitor who specialises in cross-border property transactions is non-negotiable. Their fees are a necessary cost to ensure your purchase is legally sound.

- Valuation and Survey Fees: Your lender will require a valuation, but it is prudent to commission a more detailed structural survey to identify latent defects that could lead to expensive future repairs.

- Mortgage Arrangement Fees: These are fees charged by lenders to set up your buy-to-let mortgage.

Your initial capital must comfortably cover the deposit, all transaction costs, and a contingency fund. A sound rule of thumb is to hold at least three to six months of operational costs in reserve. This includes mortgage payments and potential maintenance, safeguarding your investment against an unexpected vacancy or equipment failure.

Assemble Your Professional Team

Attempting to navigate an international property purchase independently is a high-risk strategy. Assembling a team of qualified professionals is not a luxury—it is an absolute necessity for a secure and successful investment. This team will provide the critical local knowledge you lack.

Your core team should include:

- A Mortgage Advisor: Seek an individual with specific experience in buy-to-let and investor finance. They will understand the stricter lending criteria for investment properties.

- A Specialist Solicitor: This is crucial. Your legal expert must be proficient in the property laws of your target country and have a demonstrable track record of handling transactions for foreign buyers.

- A Local Letting Agent: A reputable, trustworthy agent on the ground is invaluable. They can provide accurate intelligence on local rental demand, achievable rents, and desirable neighbourhoods long before you consider making an offer.

This team acts as your primary defence against costly errors. Their combined expertise ensures that every aspect of the process, from finance and legalities to market specifics, is handled professionally, allowing you to invest with confidence.

Mastering Market Research and Analysis

The adage 'location, location, location' assumes even greater significance when purchasing an investment property in an unfamiliar territory. True success is derived from data-driven research that goes beyond marketing materials. This involves understanding both the macroeconomic health of a region and the granular details of a specific street.

A robust market analysis begins with the macro view. You are looking for clear, sustainable drivers of residential demand. Key indicators include consistent population growth, significant public or private investment in infrastructure, and a diverse base of major employers such as universities, hospitals, or technology hubs.

For example, data from national statistics offices, such as the ONS in the UK, can reveal which cities are attracting skilled workers. A city with both a growing population and a major infrastructure project, such as a new rail line or business park, is a strong candidate for sustained rental demand.

Drilling Down to Macroeconomic Fundamentals

Before examining a specific property, you must understand the economic drivers of a city or region. This top-down approach acts as a filter, helping you to discard locations built on short-term hype and focus on those with genuine, long-term potential.

Look for these positive indicators:

- Sustained Job Growth: A diversified economy, not reliant on a single industry, is more resilient. Review local employment data from bodies like local authorities to identify which sectors are expanding.

- Infrastructure Investment: Projects like new transport links, hospitals, or schools enhance liveability and act as powerful magnets for tenants, catalysing property price growth.

- Demographic Shifts: Is the area attracting young professionals or growing families? Understanding inbound demographics helps determine which type of property will be in highest demand.

A classic mistake is to pursue the highest advertised yields without verifying the underlying economic fundamentals. High yields can sometimes be a red flag for higher risk. It is critical to ask why the yield is high. Is it due to strong, sustainable tenant demand, or because property values are depressed for a valid reason?

Comparing different market types is instructive. Consider a university city in the UK, such as Manchester. It offers highly consistent rental demand from an annual influx of students. Yields are generally stable and voids are low, though capital growth is more likely to be steady than spectacular.

Contrast this with a holiday-let property in Portugal's Algarve region. The investment case is built on high seasonal demand, which can deliver superior yields during peak months. However, this is accompanied by the risk of longer void periods in the off-season and a market more sensitive to tourism trends. Neither is inherently "better"; they simply align with different investment strategies. For more ideas, you may find value in our guide on top emerging property investment markets.

Micro-Level Analysis: On-the-Ground Intelligence

Once you have identified a promising city or region, the critical work begins at the neighbourhood level. This is where your investment's success will be determined. You must analyse the specific postcode, and sometimes even the street, to ensure it will attract and retain high-quality tenants.

Your checklist for this local-level analysis should include:

- Transport Links: Proximity to train stations, bus routes, or major roads is a top priority for most professional tenants.

- Local Amenities: Proximity to good schools, parks, supermarkets, gyms, and restaurants makes a location more desirable and supports higher rental values.

- Safety and Crime Rates: Use official local police data and online resources to assess a neighbourhood's safety. A low crime rate is non-negotiable for attracting reliable, long-term tenants.

- Rental Supply and Demand: Review local letting agent websites. An oversupply of available rental stock will inevitably suppress rents and increase your void periods.

By combining this top-down macroeconomic view with a bottom-up local analysis, you build a comprehensive, 360-degree picture of an area's investment potential. This methodical approach is the foundation for purchasing an investment property that delivers reliable returns.

Calculating Your True Return on Investment

Successful property investment is a discipline of financial analysis, not speculation. Emotional decision-making is a direct path to a poor investment; every choice must be grounded in objective data. Before submitting an offer, you must be confident that the property can generate a viable return.

This requires looking beyond the headline purchase price and estimated rental income. The true profitability of an asset is revealed only after accounting for all expenses, from management fees and insurance to maintenance costs and potential void periods. Mastering these calculations is what distinguishes strategic investors from speculators.

It begins with understanding two fundamental metrics: Gross and Net Yield. They tell very different stories about a property's performance.

From Gross Yield to Net Yield

Gross Rental Yield is the most basic measure of return. It is a quick, high-level indicator useful for initial comparisons between shortlisted properties. It is calculated by dividing the annual rental income by the property’s purchase price.

- Formula: (Annual Rental Income / Property Purchase Price) x 100 = Gross Yield %

For example, a £250,000 flat in Manchester generating £1,200 per month (£14,400 per annum) would have a gross yield of 5.76%. It is a useful starting point, but it is misleading as it ignores all ownership costs.

This is where the more insightful metric, Net Rental Yield, becomes essential. This calculation provides a realistic picture of your return by subtracting all annual running costs from your rental income before the division.

These costs must be factored in:

- Property Management Fees: Typically between 8-15% of the monthly rent.

- Insurance: Landlord and buildings insurance are mandatory.

- Maintenance and Repairs: A prudent budget is 1% of the property’s value annually.

- Void Periods: Astute investors factor in at least one month of vacancy per year as a standard contingency.

- Service Charges and Ground Rent: Common for flats and leasehold properties, these can significantly erode profit.

By subtracting these real-world expenses, the Net Yield reveals what you actually earn from the investment. It is the number that truly matters for your bottom line and is fundamental to making a sound decision when purchasing an investment property.

Projecting Cash Flow and Capitalisation Rate

Beyond yield, you must understand your monthly cash flow—the money remaining after all expenses, including your mortgage payment, have been paid. A positive cash flow property is self-sustaining and profitable from day one. Negative cash flow means you are subsidising the property from your own funds, a high-risk position.

The Capitalisation Rate (Cap Rate) is another powerful tool for comparing different investment opportunities. It measures the property's net operating income (NOI) relative to its current market value. The NOI is your gross rental income minus all operating expenses, but excluding mortgage payments.

- Formula: (Net Operating Income / Current Market Value) x 100 = Cap Rate %

A higher cap rate may signal a higher return but can also indicate higher risk. It is an excellent metric for assessing the relative value of properties, allowing you to compare diverse assets on a level playing field. For a detailed walkthrough of these calculations, refer to our guide on how to calculate ROI for real estate.

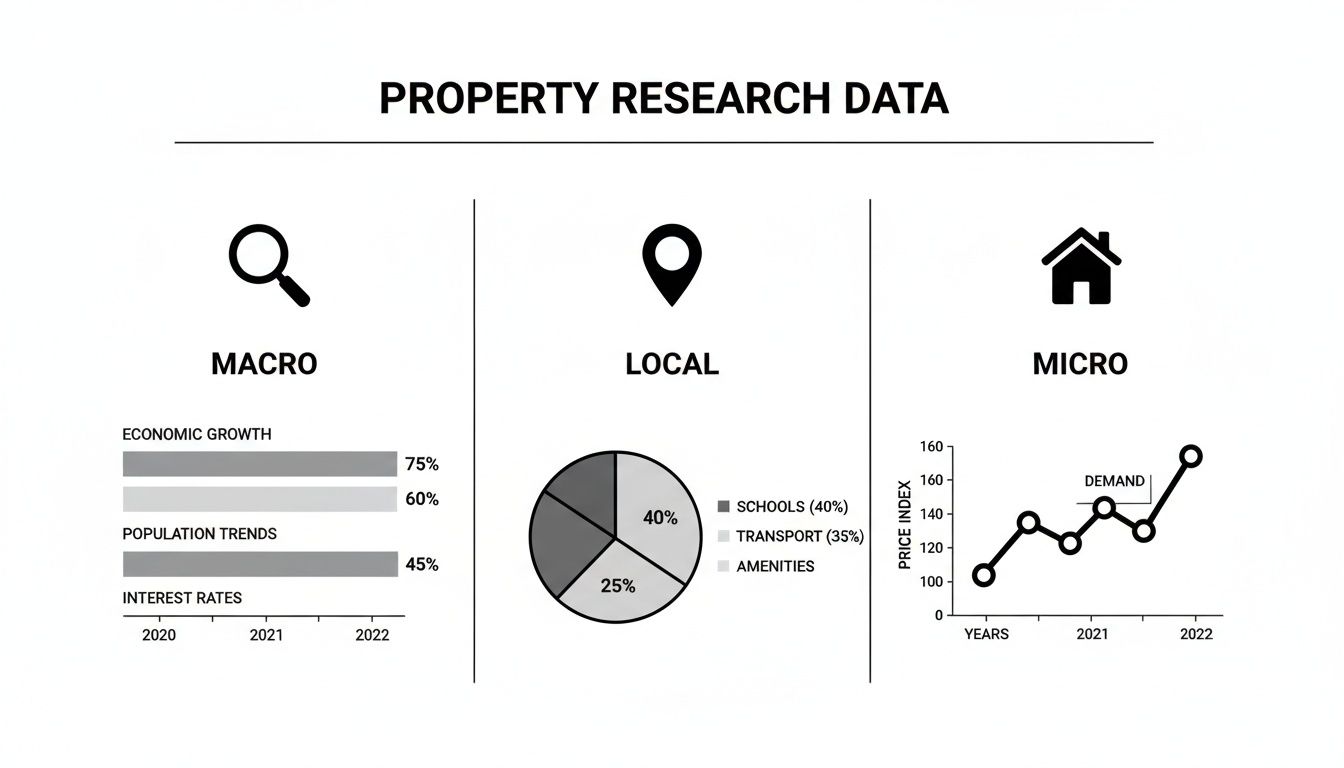

This infographic breaks down the three core levels of property research, helping you move from a high-level market overview to the granular detail of a specific property.

This structured approach ensures your calculations are built on a solid foundation of market knowledge, from macroeconomic trends down to street-level specifics.

Rental Yield and Cash Flow Calculation Example (Manchester vs. Dubai)

To illustrate these principles, let's compare a two-bedroom flat in Manchester, UK, with a similar property in Dubai, UAE. This table provides a simplified comparison of key metrics.

| Metric | UK Example (Manchester) | UAE Example (Dubai) |

|---|---|---|

| Purchase Price | £250,000 | AED 1,500,000 (~£325,000) |

| Annual Rent | £14,400 | AED 100,000 (~£21,700) |

| Gross Yield | 5.76% | 6.68% |

| Annual Costs | £3,500 (Management, insurance, voids) | AED 15,000 (~£3,250) (Service charges, fees) |

| Net Operating Income | £10,900 | AED 85,000 (~£18,450) |

| Net Yield | 4.36% | 5.68% |

On the surface, Dubai appears to offer a higher return. However, this simplified analysis omits crucial factors such as mortgage costs, disparate tax regimes, and the potential for capital appreciation. A complete financial model would be required to determine the superior long-term investment.

Strong rental yields are a key driver in markets like the UK. For instance, credible analysis suggests total UK real estate returns could reach 8.7% over the 12 months to August 2025, driven more by income returns than by capital growth alone, as per recent market forecasts.

Navigating International Legal and Tax Regulations

Understanding the local legal and tax landscape is not a procedural formality—it is one of the most critical components of purchasing property abroad. Each country has a unique regulatory framework, and these differences can dramatically alter your acquisition costs, ongoing expenses, and ultimate profit. Overlooking these details is one of the most expensive mistakes an international investor can make.

One of the first concepts to grasp is the structure of property ownership. In the UK, properties are typically sold as either freehold or leasehold. Freehold grants ownership of the building and the land it occupies in perpetuity. Leasehold, conversely, grants ownership of the property for a fixed term, without ownership of the underlying land.

This distinction has significant implications. Leasehold properties almost always involve annual ground rent and service charges, which must be factored into your net yield calculations to avoid eroding returns.

Understanding Ownership Structures and Restrictions

Beyond the type of tenure, many countries have specific rules regarding foreign ownership. Some emerging markets may restrict foreign ownership to designated zones or require partnership with a local citizen. In contrast, established markets like the UK or Spain are generally open to international investors.

It is essential to gain clarity on these rules before investing time and capital in a property search. A specialist international property solicitor is your most valuable resource here. They can confirm the exact regulations applicable to your nationality in your chosen location, preventing a transaction from failing at a late stage.

Key Takeaway: Never assume the property laws of your home country apply elsewhere. Securing local legal advice is not a suggestion; it is a fundamental requirement for protecting your capital and ensuring your purchase is legally compliant.

The Impact of Transactional Taxes

The act of purchasing a property triggers a series of taxes that can substantially increase your upfront costs. These taxes vary enormously between jurisdictions and must be budgeted for from the outset.

- Stamp Duty Land Tax (SDLT) in the UK: Purchasing a second property in England or Northern Ireland incurs a higher rate of SDLT. As of late 2025, this surcharge adds a significant sum to the purchase price, directly impacting the capital required to complete the deal.

- Property Transfer Tax: Most countries have an equivalent tax. In Spain, the Impuesto sobre Transmisiones Patrimoniales (ITP) is a regional tax on resale properties that varies by autonomous community.

- Capital Gains Tax (CGT): This is the tax payable on your profit upon disposal of the asset. Rates and allowances differ globally. Non-residents who own UK property, for example, are liable for CGT on any gains realised, as specified by Gov.uk.

For a more detailed examination of these costs, you can learn more about property taxes in our comprehensive guide.

Ongoing Tax Liabilities and Double-Taxation Treaties

Your tax obligations do not cease upon acquisition. Rental income earned will almost certainly be taxed in the country where the property is located. Tax authorities like HMRC in the UK have clear rules for non-resident landlords, who must declare their rental profits annually.

This is where double-taxation treaties are critically important. These are agreements between countries designed to prevent you from being taxed twice on the same income—once in the investment location and again in your country of residence.

A treaty may allow you to offset tax paid abroad against your domestic tax liability. However, navigating these agreements is a specialist task. You will require a tax advisor with expertise in both jurisdictions. They can help structure your investment in the most tax-efficient manner, ensuring compliance while optimising your net income.

Securing the Purchase: From Offer to Ownership

You have identified a suitable property, and your financial analysis is positive. Now is the time to translate theory into action. This stage requires careful negotiation, meticulous legal work, and a clear strategy to convert a promising opportunity into a tangible asset.

Submitting an offer is a strategic opening, not merely a number. Your offer should be firmly based on your research—the property's genuine market value, its condition, and what your own calculations indicate it can deliver as an investment.

A sensible initial offer demonstrates you are a serious buyer, but an offer that is too low risks the seller refusing to negotiate. It is a fine balance.

Securing an Accepted Offer

Effective negotiation is based on information. If your viewing revealed a dated kitchen or rooms requiring redecoration, use these points as leverage to justify your offer.

Always be prepared for a counteroffer and, critically, establish your absolute maximum price before negotiations begin. Never allow emotion to push you beyond a figure that is financially viable.

Once your offer is accepted, the legal process commences. In the UK, this is known as conveyancing, where your specialist solicitor manages the transfer of legal title from seller to buyer.

The mechanics of this process vary significantly between countries. In Spain, a binding private purchase contract (contrato de arras) is often signed early with a substantial deposit. In England, the deal is not legally binding until the formal exchange of contracts, which occurs much later.

This is also the point at which you must finalise your mortgage or funding arrangements. For a better understanding of this stage, consult our comprehensive guide on financing an investment property.

The Non-Negotiable Step: Due Diligence

An accepted offer is the start of your final checks, not the end of the process. Proper due diligence is the safety net that protects you from discovering costly issues after taking possession. This is absolutely critical when buying remotely.

Your checklist should, at a minimum, include:

- A Professional Building Survey: This is far more in-depth than a basic mortgage valuation. A surveyor will assess the building's structural integrity, search for signs of damp, inspect the roof, and identify major defects that could be expensive to rectify.

- Legal and Title Checks: Your solicitor will conduct searches with local authorities. They are looking for planning restrictions, nearby developments, or public rights of way that might impact the property's value. They also verify that the seller has the legal right to sell.

- Specialist Inspections: Depending on the property’s age and location, specific reports on issues such as asbestos, subsidence, or outdated electrical systems may be required.

Never be tempted to skip a full survey to save a few hundred pounds. A detailed report uncovering a hidden structural issue could save you tens of thousands in the long run and provides powerful grounds for renegotiating the purchase price.

From Exchange of Contracts to Completion

In the UK system, the point of no return is the exchange of contracts. This is when you pay your deposit and the purchase becomes legally binding. Withdrawing after this point will result in the forfeiture of your deposit, and you could be subject to legal action by the seller.

The final step is completion. This is the day the remaining funds are transferred to the seller's solicitor, and you officially become the owner. The keys are released, and you are officially a property investor.

In stable, established markets, this process is generally predictable. In the UK property market of late 2025, for instance, average house prices according to the ONS reached £270,000, representing a modest 1.7% annual increase. This slow but steady growth indicates a market that rewards investors focused on long-term capital appreciation rather than speculative short-term gains. You can find more UK house price data at ONS.gov.uk.

Frequently Asked Questions for Investors

Embarking on property investment, particularly abroad, invariably raises crucial questions. From arranging finance to determining management strategy from afar, understanding the fundamentals is the first step.

Here are some of the most common queries from investors, with direct, practical answers.

What Deposit Is Required for a Buy-to-Let Mortgage?

When considering a buy-to-let (BTL) mortgage, particularly in markets like the UK, the requirements differ significantly from residential loans. Lenders are more cautious and require a greater financial commitment from the borrower.

You should budget for a deposit of at least 25% of the property’s value. In practice, this can range from 20% to 40%, depending on your financial circumstances and the lender's assessment of the transaction's risk.

Lenders focus on the property's financial viability. They will conduct a "stress test" to ensure the projected rental income can cover the mortgage interest payments by a significant margin—typically between 125% and 145%. If the rental income is particularly strong, a slightly smaller deposit may be accepted, but using 25% as your baseline is the most prudent approach for planning.

Should I Self-Manage or Appoint an Agent?

This decision represents a trade-off between your capital and your time. Self-managing a property can save on fees but is a significant commitment. For non-resident investors, it is almost entirely impractical.

- Self-Management: You are responsible for finding and vetting tenants, arranging repairs at all hours, and ensuring compliance with all local regulations. It is an active role, not a passive investment.

- Hiring an Agent: For international investors, a professional property manager is a necessity, not a luxury. They handle all operational aspects, transforming your property into a hands-off income-producing asset. Their fees—typically 8-15% of the monthly rent—must be factored into your financial projections from day one.

For most overseas investors, the local expertise and peace of mind provided by a reputable agent are well worth the cost.

The greatest risks in overseas investment are often factors beyond your direct control. Currency fluctuations can impact returns, unfamiliar legal systems can create costly compliance issues, and a lack of on-the-ground knowledge can lead to a poor acquisition. A local management team is your most effective defence against these challenges.

What Are the Primary Risks of Investing in Property Abroad?

Investing outside your home market introduces a unique set of challenges. The three most significant are typically currency fluctuations, complex legal systems, and a lack of local insight. For example, an adverse movement in the exchange rate can significantly reduce both your rental income and the property's value when repatriated to your home currency.

Navigating unfamiliar tax and property laws is another major challenge. Each country has different regulations, and non-compliance can lead to severe financial penalties. The most effective way to mitigate these risks is to build a trusted local team from the outset: a solicitor with market expertise, a tax advisor, and a letting agent with deep local knowledge.

Is It Better to Pursue Capital Growth or Rental Yield?

This is not a binary choice; the most robust portfolios often incorporate both. However, your primary focus should align directly with your financial objectives.

- Targeting Capital Growth: This is a long-term strategy. You invest in areas with strong fundamentals for future price appreciation, such as major global cities with expanding economies. This may require accepting a lower initial rental income in anticipation of significant capital gains over a ten or twenty-year horizon.

- Focusing on Rental Yield: This strategy prioritises generating strong, predictable cash flow from the outset. It typically involves investing in more affordable locations with high tenant demand—such as university cities or major regional hubs where rents are high relative to property prices.

A well-balanced portfolio might include a high-growth city-centre flat alongside several high-yielding properties in a regional town. This provides a blend of regular income for operational costs and long-term growth to build wealth.

At World Property Investor, we provide the in-depth guides and market analysis you need to make informed decisions. Explore our resources to compare markets, understand local rules, and invest with confidence. Find your next opportunity at https://www.worldpropertyinvestor.com.