For any serious property investor, understanding the difference between freehold and leasehold tenure is not a mere technicality—it is fundamental to risk assessment and portfolio strategy. These two forms of ownership dictate long-term costs, responsibilities, asset control, and ultimately, the property's capital appreciation potential.

In simple terms, a freehold title grants complete and perpetual ownership of a property and the land upon which it is built. Conversely, a leasehold title confers the right to occupy a property for a fixed period. The leaseholder owns the property for the duration of the lease, but the land itself remains under the ownership of the freeholder, also known as the landlord.

This distinction is critical for evaluating the long-term viability and return on investment (ROI) of a property asset.

Defining Freehold and Leasehold Ownership

A sound investment begins with a precise understanding of the asset being acquired. The choice between freehold and leasehold has profound financial implications that affect an investor's rights, liabilities, and control over the property for its entire holding period.

What is a Freehold?

A freehold title is the most absolute form of property ownership available in legal systems such as that of England and Wales. The owner holds the title to both the building and the land in perpetuity.

As the outright owner, the freeholder is solely responsible for all maintenance, repairs, and insurance. This autonomy allows for alterations and extensions (subject to local planning regulations) without requiring consent from a third-party landlord, a key advantage for value-add investment strategies.

What is a Leasehold?

A leasehold is a long-term tenancy agreement, legally defined by the lease contract between the leaseholder (tenant) and the freeholder (landlord). The lease specifies the duration of ownership, which commonly starts at 99, 125, or 999 years.

As the leaseholder, you purchase the right to occupy the property for this term but must adhere to the covenants within the lease. These obligations almost always include ongoing payments, such as ground rent and service charges, and restrictions on property use or alteration. A firm grasp of these concepts is a cornerstone of prudent investment, as detailed in our beginner's guide to real estate investing.

Core Differences: Freehold vs Leasehold

For an investor, these distinctions directly influence ROI, ongoing liabilities, and the asset's liquidity upon exit. The table below outlines the defining attributes of each tenure.

| Attribute | Freehold | Leasehold |

|---|---|---|

| Ownership | Perpetual ownership of the property and the land it occupies. | Ownership of the right to use the property for a fixed term. |

| Duration | Indefinite and perpetual. | Limited to the length of the lease (e.g., 99-999 years). |

| Control & Autonomy | Full control over alterations, subject to planning law. | Limited control; requires freeholder consent for major changes. |

| Ongoing Costs | No ground rent or service charges. | Annual ground rent and service charges are typically payable. |

| Responsibilities | Sole responsibility for all building and land maintenance. | Responsible for internal maintenance; freeholder manages building insurance and communal areas. |

| Typical Property | Houses and commercial buildings. | Flats (apartments) and some new-build houses. |

These differences highlight a crucial point for investors focused on long-term returns and asset security.

Investor Takeaway: Freehold represents ownership of a perpetual asset. Leasehold represents a depreciating right to use an asset. As a lease term shortens, the value of a leasehold property erodes, introducing a risk factor—lease decay—not present in freehold investments.

The Strategic Advantages of Freehold Investing

For the majority of long-term global property investors, freehold ownership is the preferred tenure. It represents the highest degree of control and security, making it the benchmark for stable, appreciating real estate assets. Owning the building and, critically, the land it sits on eliminates the complexities and financial drag associated with a third-party freeholder.

This direct ownership model provides complete autonomy. As a freeholder, you can renovate, extend, or redevelop (subject to planning consent) without seeking permission from a landlord. This control is vital for any value-add strategy, such as adding an extension or converting a loft, which can significantly increase both rental yield and capital value.

Maximising Financial Control and Returns

A primary financial argument for freehold is the absence of recurring lease-related costs. Freehold properties are not subject to ground rent—a fee that provides no tangible benefit and can, in some cases, escalate aggressively.

Furthermore, freehold ownership avoids the variable and often unpredictable service charges common in leasehold properties for the maintenance of communal areas. According to Gov.uk data, these charges are a frequent source of disputes and can directly erode an investor's net yield. Eliminating these variable costs results in a more predictable and stable cash flow, a critical factor when you determine a property's investment potential.

Owning the freehold ensures your net operating income is not diluted by charges beyond your control. This financial clarity simplifies forecasting and strengthens the long-term viability of the investment, making it a cornerstone for growth-oriented portfolios.

Underpinning Long-Term Capital Growth

Fundamentally, long-term capital appreciation in real estate is driven by the value of the land. With a freehold title, an investor owns this appreciating asset directly. This not only enhances the property's resale value but also makes it a more liquid asset on the open market, as both purchasers and lenders favour the security and simplicity of freehold tenure.

This preference is evident in mature markets. In the UK, for instance, freehold is the standard tenure for houses outside major city centres. Recent analysis of ONS figures shows strong regional demand for outright ownership, with Leeds recording 9,841 freehold sales, followed by Birmingham with 8,752. You can discover more about UK freehold property hotspots in this detailed analysis.

In emerging markets such as Dubai, designated freehold zones were created specifically to attract foreign capital by offering this secure form of ownership. This global trend underscores a core investment principle: where available, the security and control of freehold tenure are the preferred routes for building sustainable wealth.

Analysing the Risks of Leasehold Properties

While leasehold properties can offer a lower entry point into prime markets, a prudent investor must conduct rigorous due diligence to mitigate the unique financial risks associated with this tenure. A leasehold is a long-term contract with an expiration date, which introduces complexities that must be carefully evaluated.

The lease agreement itself is the central document defining an investor's rights and obligations. Three critical areas require scrutiny: the length of the remaining lease term, the ground rent provisions, and the structure of service charges. Misjudging any of these can severely impact net returns and the asset's long-term value.

The Financial Impact of Lease Decay

The most significant risk inherent in leasehold ownership is lease decay: the process by which a leasehold property loses value as its remaining term shortens. While a new lease of 900 years is functionally similar to freehold, the property's value and mortgageability begin to decline significantly once the term falls below a critical threshold.

This decline accelerates sharply as a lease drops below 80 years. At this point, many mortgage lenders will not offer finance, severely restricting the pool of potential buyers to cash purchasers and depressing the property's market value.

Investor Takeaway: A short lease can transform a promising asset into a depreciating liability. The cost of extending it, particularly the calculation of 'marriage value' below the 80-year mark, can be substantial. Failure to act results in a quantifiable and accelerating loss of capital.

Ground Rent and Service Charge Liabilities

Beyond lease length, ongoing costs can erode profitability. Ground rent is a payment made to the freeholder for the use of the land, providing no direct benefit to the leaseholder. Historically, some leases contained aggressive review clauses, such as doubling every ten years, which rendered properties unsaleable.

Similarly, service charges—the leaseholder's contribution to the maintenance of communal areas and building insurance—can be unpredictable. Inefficient or unscrupulous management by the freeholder can lead to inflated charges that directly reduce an investor's rental yield. It is essential to review at least three years of service charge accounts to identify trends or planned major works.

In the UK, legislative reforms are addressing these issues. The Leasehold Reform (Ground Rent) Act 2022 has already abolished ground rents for most new leases. Further proposed reforms aim to cap existing ground rents and simplify the process for leaseholders to challenge unreasonable service charges or acquire their freehold, thereby reducing investor risk.

Understanding Lease Extensions

For properties with shorter leases, a statutory lease extension is often necessary to preserve value. In England and Wales, qualifying leaseholders have the legal right to extend a flat's lease by 90 years or a house's lease by 50 years, reducing the ground rent to zero (a 'peppercorn' rent).

This process is neither quick nor inexpensive. It involves:

- Serving a formal legal notice on the freeholder.

- Negotiating a premium, which can amount to tens of thousands of pounds.

- Paying your own legal and valuation fees, in addition to the freeholder's reasonable costs.

Factoring these potential costs into the initial offer price is non-negotiable for the investment to be financially viable. This due diligence is critical, especially when investing in overseas property, where local laws on lease extensions may differ significantly.

Comparing Global Property Tenure Systems

Property ownership frameworks vary significantly across international markets. While the freehold vs leasehold distinction is central to UK real estate, a global investor must adapt their due diligence to local legal systems to accurately assess opportunities and mitigate risks.

These differences fundamentally alter an asset’s risk profile, its potential for capital growth, and the degree of control an owner possesses. An investor accustomed to the perpetual ownership of a UK freehold may find the nuances in other jurisdictions require a different strategic approach.

Established Western Markets: UK, US & Europe

In the United States, the equivalent of freehold is 'fee simple' absolute ownership. This is the highest form of ownership, granting the owner indefinite rights to the property and the land, and is standard for single-family homes. For apartments (condominiums), owners typically hold a fee simple title to their unit plus a share in the common areas, governed by a homeowners' association.

Across Europe, systems vary. In Spain, 'pleno dominio' (full ownership) mirrors the rights of a UK freehold. For apartments, however, the 'propiedad horizontal' (horizontal property) system prevails, where an owner holds title to their unit plus a co-ownership share of communal elements, managed by a community of owners. France operates a similar structure for apartments, known as 'copropriété'.

While fee simple, pleno dominio, and freehold all grant absolute land ownership, European apartment systems introduce shared governance structures that impact an investor's autonomous control over the asset.

Emerging and Hybrid Markets: UAE & Asia

Emerging markets often create specific legal frameworks to attract foreign investment, resulting in hybrid tenure systems. The United Arab Emirates, particularly Dubai, is a prime example. To open its market, the government established designated 'freehold zones'.

Within these zones, non-GCC nationals can acquire property with a title deed registered at the Dubai Land Department, granting outright ownership. Outside these designated areas, foreign ownership is typically restricted to leasehold, with terms up to 99 years. This geographical distinction makes precise location verification essential.

In contrast, Japan has a well-established concept of freehold ownership but also a prevalent 'shakuchi-ken' (leasehold) system. These leaseholds are complex, with different laws governing agreements made pre- and post-1992. Verifying whether a lease is renewable or a fixed-term contract requiring the land to be returned is critical. A deep dive into local market practices is invaluable here; explore more insights in our property investment guides.

This global overview demonstrates that while outright ownership is a common goal, its implementation varies. Investors must look beyond marketing terms and examine local land laws and property registers to confirm the precise nature of the title being acquired.

How Tenure Shapes Investment Finance and Valuation

The distinction between freehold and leasehold is not merely legal; it fundamentally alters a property's financial profile. For a global investor, understanding how tenure impacts mortgageability, taxation, and valuation is essential for accurate deal analysis.

Lenders view these two ownership types through different risk lenses. A property’s tenure is a primary factor in underwriting, and a lender's assessment dictates financing terms. Freehold is straightforward: the property and land are valued as a perpetual asset. Leasehold, however, introduces the finite lease term—a variable that lenders perceive as a direct risk.

Lender Scrutiny and the 80-Year Cliff Edge

The remaining lease term is a critical factor for mortgage approval. In the UK, most lenders become cautious once a lease drops below 80 years. This is because below this threshold, the property's value erodes more rapidly, and the cost of a lease extension increases significantly due to the inclusion of 'marriage value'.

Consequently, lenders often require the lease to have at least 30 to 40 years remaining after the mortgage term ends. An application for a 25-year mortgage on a property with a 70-year lease is therefore likely to be rejected. This financing constraint reduces the pool of potential future buyers, impacting the property's liquidity and market value.

Investor Takeaway: A short lease is a significant red flag for lenders, who are underwriting a loan against a depreciating asset. For an investor, a property with a 75-year lease is not just a valuation issue but a major financing obstacle that could jeopardise an exit strategy.

Tax Implications for Buy-to-Let Investors

From a taxation perspective, the ongoing costs associated with leasehold properties can provide some benefits for buy-to-let investors. In the UK, expenses incurred "wholly and exclusively" for the purpose of the rental business are deductible from rental income, thereby reducing the investor's taxable profit.

These allowable expenses typically include:

- Ground Rent: Annual payments to the freeholder are tax-deductible.

- Service Charges: Fees for communal maintenance, building insurance, and management are also deductible.

- Repairs: Both costs for repairs within the property and contributions to communal repairs qualify.

While these deductions reduce an investor's tax liability, they are offsetting costs that a freehold investor does not incur. A freehold owner has fewer deductible running costs but retains a higher proportion of gross rental income from the outset. For a more detailed analysis, learn about financing an investment property in our dedicated guide.

Valuation and Capital Growth: A Long-Term View

Ultimately, tenure has a direct and measurable impact on a property's value. Freehold properties command a premium over comparable leaseholds because the purchaser acquires a perpetual asset—both the building and the appreciating land it occupies.

A leasehold property, conversely, is valued based on the right to occupy for a finite period. As this term diminishes, its value erodes through lease decay. The concept of 'marriage value' makes extending a lease below 80 years disproportionately expensive, and a prudent buyer will factor this future cost into any present offer. This fundamental difference is why freehold properties typically offer more reliable, long-term capital growth.

Making the Right Investment Decision

This analysis can now be consolidated into a practical framework for decision-making. A successful investment requires a robust due diligence process that aligns the tenure type with your specific financial objectives.

This process starts with asking the right questions, particularly for a leasehold asset. Initial enquiries should focus on the long-term health of the lease contract to identify hidden liabilities that could erode returns and impede a future sale.

Essential Due Diligence Checklist for Leaseholds

Before submitting an offer on a leasehold property, instruct your solicitor and surveyor to verify these critical points.

- Remaining Lease Term: What is the exact number of years remaining? If it is approaching or below 80 years, you must immediately calculate and factor in the cost of a statutory lease extension.

- Ground Rent Covenants: What is the current ground rent, and what are the review provisions? Scrutinise the lease for aggressive review clauses, such as doubling every ten years, which can render an investment toxic.

- Service Charge History: Request a minimum of three years of service charge accounts. Look for evidence of competent management, reasonable charges, and any indications of major impending works that could lead to large one-off levies.

- Restrictive Covenants: Does the lease restrict subletting, alterations, or other activities essential to your investment plan? Such clauses can significantly limit your ability to optimise the asset.

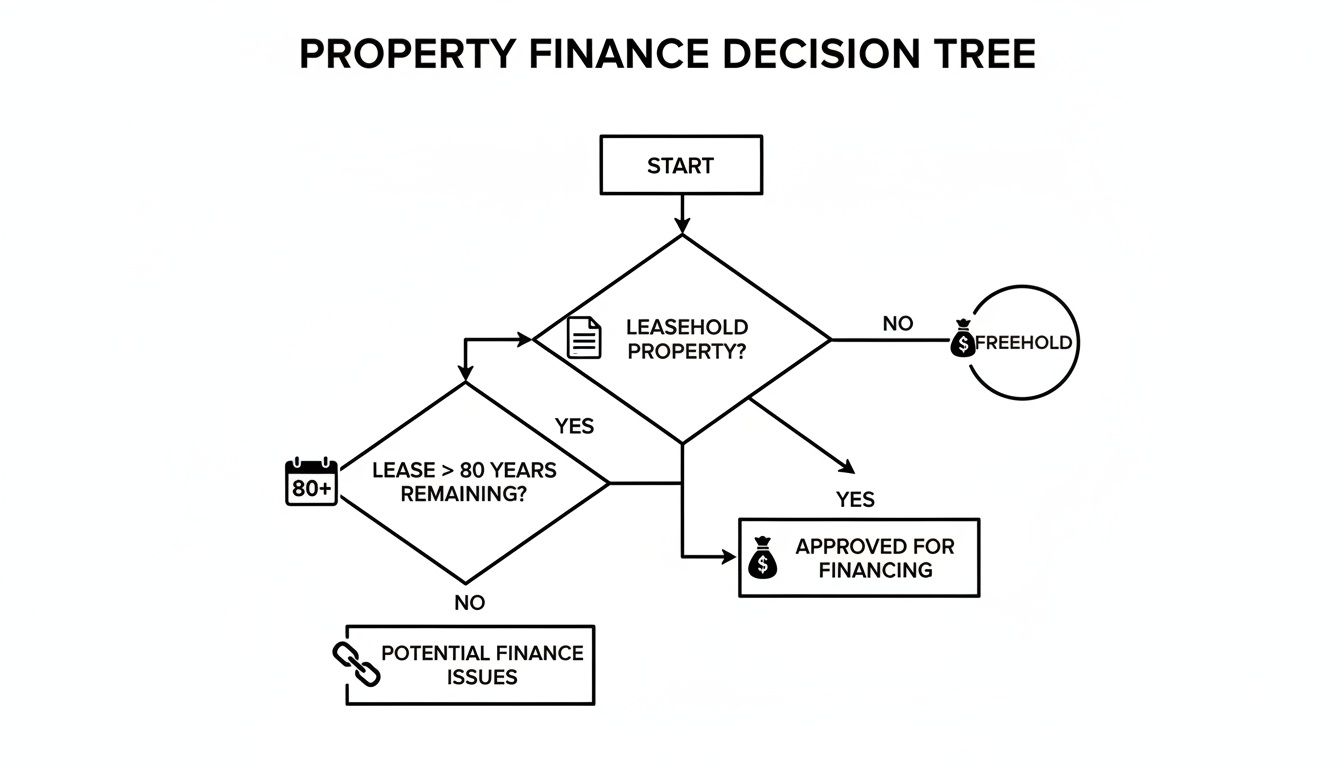

This decision tree illustrates how the lease term alone can determine the viability of a deal from a financing perspective.

As shown, the 80-year threshold is a critical demarcation point for most mortgage lenders. A short lease signifies heightened risk, often resulting in a rejected mortgage application.

Matching Tenure to Investment Strategy

The optimal choice between freehold and leasehold depends entirely on your investment timeline, risk tolerance, and primary objective—be it cash flow or capital growth.

For an investor prioritising long-term, stable capital appreciation, a freehold house is almost always the superior choice. It offers complete control and direct ownership of the appreciating land asset, free from the financial drag of lease decay and escalating service charges.

However, a leasehold can be a strategic choice for other investment models.

When Leasehold Makes Sense: An investor focused on maximising rental yield in a prime city centre might prefer a long-leasehold flat. These properties often have a lower acquisition cost, providing access to high-demand rental markets like central London or Manchester. Provided the lease is long (e.g., 125 years or more) and service charges are reasonable, the higher rental returns can justify the tenure for a medium-term hold.

Ultimately, the decision rests on a clear-eyed assessment of risk and reward. Conduct thorough due diligence, define your objectives, and align the property’s tenure with your financial strategy. This data-driven approach is the foundation for building a robust and valuable property portfolio.

Frequently Asked Questions

When evaluating freehold vs leasehold, several key questions consistently arise. Clear, practical answers are crucial for making an informed investment decision.

Is Buying a Share of the Freehold a Good Investment?

Yes, from an investor's perspective, acquiring a 'share of freehold' is often a strategically advantageous move. In this arrangement, the leaseholders collectively own the freehold of the building.

This structure provides significant control. The co-owners can set reasonable service charges, manage maintenance efficiently, and, most importantly, grant themselves 999-year lease extensions at a nominal cost. This eliminates the risks associated with an external freeholder, thereby increasing the property’s value and making it more attractive to lenders and future buyers.

What Is the Real Cost of a Lease Extension?

The total cost of a lease extension extends beyond the premium paid to the freeholder. A comprehensive budget must account for several other significant expenses.

These costs include:

- Your own legal fees for managing the statutory process.

- The freeholder's reasonable legal fees, which the leaseholder is legally obliged to cover.

- Valuation fees for a chartered surveyor to calculate an accurate premium.

- Land Registry fees for updating the title deed upon completion.

The premium itself is calculated based on the property's value, the ground rent, and the remaining lease term. Costs increase substantially once a lease falls below the 80-year threshold, making an early, professional valuation essential.

Can a Leasehold Property Be a Better Investment?

Yes, in specific scenarios, a leasehold property can be the more suitable investment, particularly for investors with certain financial goals. Leasehold flats are typically more affordable and are predominantly located in prime urban centres with high and consistent rental demand.

For an investor prioritising short-to-medium-term rental yield over long-term capital growth, a leasehold can be a highly effective vehicle. A flat with a long lease (125+ years) and transparent, fair service charges can deliver strong, predictable cash flow in a sought-after urban location.

How Will UK Leasehold Reforms Affect Investors?

Ongoing and proposed leasehold reforms in the UK are overwhelmingly positive for property investors. Major legislative changes, such as the abolition of ground rents on new leases and proposals to simplify the lease extension process, are designed to mitigate the historical risks associated with this tenure.

For buy-to-let investors, these reforms lead to more stable and predictable assets. The changes will result in lower running costs, improved mortgageability for properties, and stronger long-term value retention. In effect, these reforms are levelling the playing field, making modern leaseholds a safer and more viable investment class.

At World Property Investor, we provide the in-depth analysis and data-driven guides you need to make confident decisions in global real estate. Whether you're comparing markets or evaluating specific deals, our resources are here to support your investment journey. https://www.worldpropertyinvestor.com