An international buy-to-let is the practice of purchasing a residential property in a foreign country with the express purpose of renting it out. This is a strategic investment designed to generate rental income and, ideally, benefit from capital appreciation in a market outside of your own. It is a methodical approach to diversifying assets geographically and accessing opportunities that may not be available domestically.

Understanding International Buy-to-Let Investing

Investing in international property is fundamentally different from acquiring a holiday home for occasional rental. It is an active investment strategy that demands a comprehensive understanding of a foreign property market's fundamentals, from its economic drivers to its distinct legal and regulatory frameworks. At its core, this strategy treats property as a global asset class, analogous to international equities or bonds.

This approach appeals to investors for several data-backed reasons. Many are pursuing higher rental yields than are achievable in their domestic markets. For instance, recent ONS data indicates that average gross rental yields in the UK hover around 6%, whereas select cities in Europe or the Middle East can offer superior returns. Others are attracted by the potential for accelerated capital growth in emerging economies or the stability offered by established, politically secure markets.

The Core Pillars of Overseas Investment

A successful international buy-to-let investment is built upon several key pillars. A firm grasp of these principles from the outset provides a solid foundation, enabling informed decisions and avoiding common pitfalls. These are not one-off considerations but ongoing requirements throughout the investment lifecycle.

Key considerations include:

- Market Analysis: This involves a rigorous evaluation of a country's economic stability, property price trends, rental demand, and significant infrastructure projects. It requires looking beyond tourist hotspots to identify areas with sustainable, long-term residential demand.

- Legal and Tax Navigation: Each country has a unique framework for foreign property ownership, taxation of rental income, and capital gains. A UK investor purchasing in Spain, for example, must understand both Spanish tax law and its interplay with their obligations to HMRC.

- Financing and Currency Management: Securing a mortgage as a non-resident presents challenges. Furthermore, fluctuations in exchange rates can materially affect both the purchase cost and the value of rental income when repatriated to your home currency.

- Property Management: Unless you reside locally, a reliable local management team is essential for handling tenants, maintenance, and compliance. This is a critical operational cost that must be factored into return on investment calculations from day one.

An international buy-to-let property is not a passive investment; it is a business. It requires thorough due diligence, a professional support team, and a clear understanding of both the potential rewards and the inherent risks. For a deeper look, our guide on investing in overseas property provides further essential insights.

Why Diversify Your Property Portfolio Globally

Concentrating all investment capital into a single, domestic property market is a high-risk strategy. A localised economic downturn, an unexpected regulatory change, or a shift in tenant demand could significantly impact your returns. Diversifying your portfolio across different countries is the antidote to this concentration risk—a deliberate strategy to protect and grow wealth across different economic cycles, currencies, and property markets.

For example, if your UK portfolio experiences slower growth due to rising interest rates, the strong rental returns from a property in a growth market like Lisbon or Dubai could provide a vital buffer, balancing overall income and stabilising your portfolio's total value. This is diversification in practice.

Mitigating Risk and Unlocking Growth

Looking beyond domestic borders allows you to build a more resilient portfolio. By investing in markets with low correlation—meaning they do not move in perfect unison—you reduce the probability of a single negative event impacting all your assets simultaneously. This strategic approach provides a powerful blend of security from stable, established markets and the higher growth potential available in emerging ones.

An international buy-to-let portfolio allows an investor to think like a global portfolio manager, identifying unique opportunities driven by local economic growth, demographic shifts, and infrastructure projects that simply aren’t available at home.

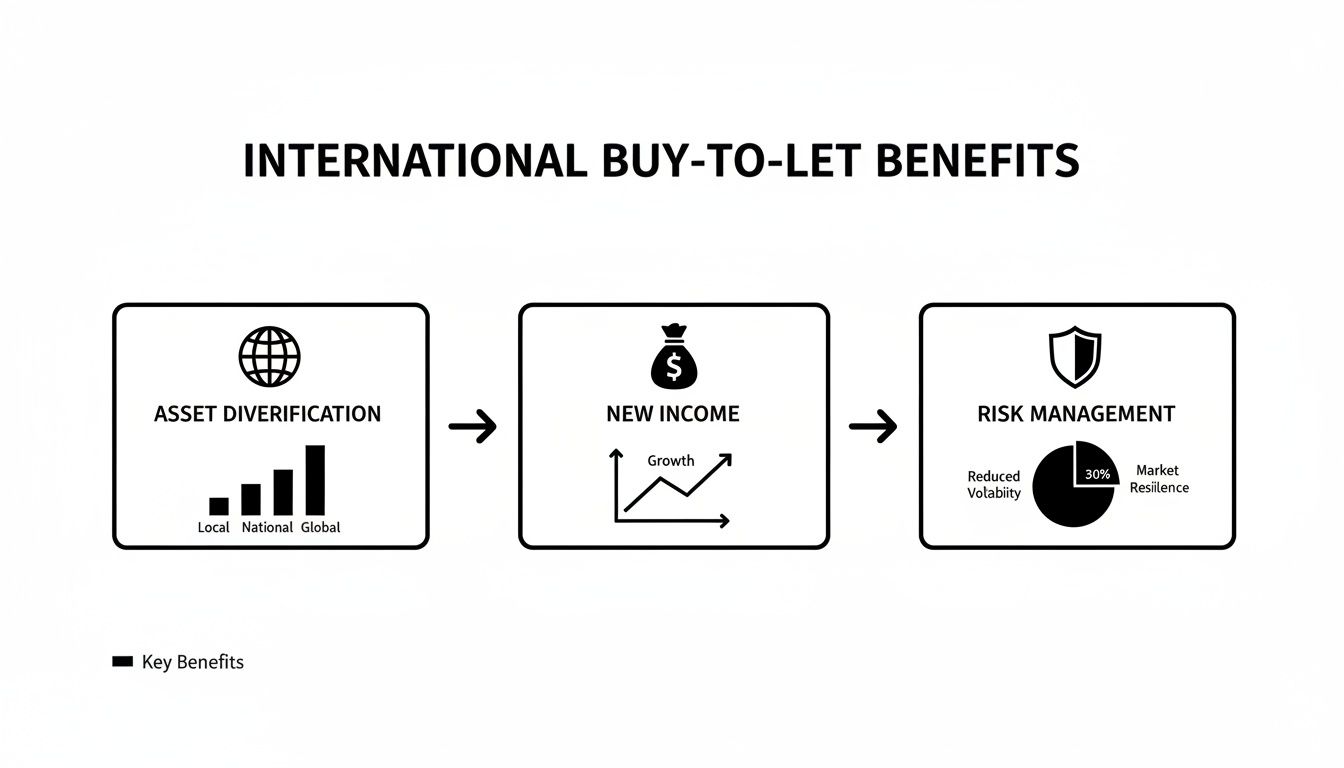

The benefits are clear: you are spreading risk, creating new income streams, and managing long-term wealth more proactively.

This visual illustrates how a global strategy moves beyond single-asset ownership towards a robust financial structure with multiple pillars of support.

Established Versus Emerging Markets

A prudent method for building an international portfolio is to balance investments between stable, mature markets and high-potential emerging economies. Each offers a different risk-reward profile.

- Established Markets (e.g., UK, Germany, USA): These locations offer political stability, transparent legal systems, and deep, liquid property markets. While capital growth may be slower, they provide reliable rental income and are often seen as a safe haven for capital.

- Emerging Markets (e.g., parts of Eastern Europe, Southeast Asia): These markets can deliver higher rental yields and greater potential for capital growth, often driven by rapid economic expansion and urbanisation. However, they also come with higher risks, such as currency volatility or less predictable legal systems.

For instance, an investor might own a flat in Manchester for its steady 5-6% gross yield and predictable tenant demand, while also investing in a developing coastal area in Greece to capture tourism-driven growth. The key is to create a blend that suits your personal risk appetite and long-term financial goals. To explore these high-growth areas further, you might find our guide on the top emerging property investment markets useful.

To provide a clearer picture, the following table compares these market types.

Market Diversification Snapshot: Established vs. Emerging Markets

| Market | Average Gross Rental Yield | Typical 5-Year Price Growth | Key Investor Benefit | Primary Risk Factor |

|---|---|---|---|---|

| UK (Established) | 4-6% | 15-25% | Stability, legal clarity, strong tenant demand | High entry prices, slower capital growth |

| Spain (Established) | 4-7% | 20-30% | Strong tourism income, lifestyle appeal | Regional economic disparities |

| USA (Established) | 5-8% | 25-40% | Market diversity, strong legal protection | High property taxes, localised downturns |

| Dubai (Emerging) | 6-10% | 30-50%+ | High yields, tax efficiency, global hub status | Market volatility, reliance on expat demand |

| Greece (Emerging) | 5-8% | 25-40% | Tourism boom, Golden Visa appeal | Bureaucracy, seasonal rental income |

| Turkey (Emerging) | 3-6% | 50-100%+ | Low entry cost, high growth potential | Currency volatility, political instability |

This table highlights the fundamental trade-off: established markets offer predictability, while emerging markets provide the potential for much higher returns, albeit with greater risks that require careful management.

Following the Global Capital Flow

The trend towards global property investment is a documented shift in investor behaviour. Sophisticated investors are increasingly looking beyond their borders to find stability and superior returns.

In the UK, for instance, international landlords are a major force in the buy-to-let sector. Analysis of Gov.uk and Companies House data reveals a significant rise in foreign investment. This confirms that building an international portfolio is no longer a niche strategy but a mainstream approach for sophisticated investors globally.

How to Evaluate International Property Markets

Successful international property investment is built on rigorous analysis, not emotion. To make sound decisions, you need a repeatable framework that cuts through marketing hype and focuses on the metrics that drive long-term returns.

This means treating every potential market as a business opportunity, demanding clear, data-backed evidence before committing capital.

The starting point is understanding the real return on investment. This requires looking beyond advertised rental figures and examining the two metrics that matter most for any buy-to-let investor.

Calculating Gross and Net Rental Yields

Rental yield is a measure of the annual return from a property, expressed as a percentage of its value. It is crucial to distinguish between the simple ‘gross’ figure and the far more important ‘net’ figure.

Gross Rental Yield is the most basic calculation. It is the total annual rent divided by the property’s purchase price, multiplied by 100. For example, a £200,000 property generating £12,000 in annual rent has a gross yield of 6%.

Gross Yield = (Annual Rental Income / Property Purchase Price) x 100

This number is useful for quick, high-level comparisons. A city like Liverpool in the UK might show gross yields of 7-8%, while a prime district in Dubai could offer 6-7%. It provides a starting point, but it does not reflect actual profitability.

Net Rental Yield provides a more accurate picture of your true return. This calculation starts with gross rental income but subtracts all annual operating costs before dividing by the total purchase cost.

These costs significantly impact profit and typically include:

- Property Management Fees: Usually 8-15% of monthly rent.

- Service Charges and Ground Rent: Common for apartments and leasehold properties.

- Landlord Insurance: Essential for protecting your asset.

- Maintenance and Repair Budgets: A prudent estimate is 1% of the property’s value annually.

- Void Periods: A provision for when the property is untenanted, often one month’s rent per year.

- Local Property Taxes: These vary dramatically between countries.

After deducting these costs, the £12,000 annual rent from our example could easily reduce to £8,000. This brings your net yield down to 4% — a far more realistic figure for financial planning.

Analysing Price Trends and Demand Drivers

A healthy yield is only one component. A successful international buy-to-let also requires the potential for capital appreciation—the increase in the property’s value over time. This necessitates research into historical price trends and, more importantly, an understanding of the future demand drivers that will sustain growth.

Begin by consulting official sources like a country’s national statistics office (such as the ONS in the UK) or land registry data. Track the house price index over the past five to ten years, looking for steady, sustainable growth rather than sharp, speculative spikes.

Beyond historical data, identify the core factors that will attract tenants and buyers in the future. These are the engines of a healthy property market.

- Economic Growth and Job Creation: Is the area attracting new businesses or becoming a hub for a specific industry like technology or finance?

- Infrastructure Investment: Are new transport links, hospitals, or universities planned that will increase the area's desirability?

- Population Growth: Is the city experiencing positive net migration, increasing the pool of potential tenants?

- Tourism and Lifestyle Appeal: For short-term lets, is tourism growing? For long-term lets, is it a desirable place to live?

Comparing a market like Dubai, where demand is often driven by expat employment, with a city like Lisbon, buoyed by tourism and the ‘Golden Visa’ programme, shows how different these drivers can be. A sound investment always has multiple, strong demand drivers underpinning its future.

For a deeper dive into this topic, you can read our guide on how to determine a property's investment potential.

Getting to Grips with Foreign Laws and Taxes

Engaging in international property investment means navigating new legal and tax systems. While this can seem daunting, with the right professional advice, it is entirely manageable. Each country has its own rules for property ownership, rental income, and capital gains, which makes expert local counsel non-negotiable.

The first hurdle is typically understanding the rules on foreign ownership. Some countries, like the UK and Spain, are open with few restrictions on non-resident buyers. Others may impose conditions, such as allowing foreigners to buy only new-build properties or in designated zones. Your first and most important action is to engage a local, independent solicitor. They act as your safeguard, responsible for checking the property title, ensuring no hidden debts exist, and confirming the transaction is legally sound.

Understanding the Legal Landscape

Beyond standard purchases, many countries use real estate to attract foreign investment through residency programmes. These 'Golden Visa' schemes are particularly prevalent in countries like Portugal, Greece, and Spain. They offer residency permits to non-EU nationals who make a qualifying property investment.

While programme details vary, this can be a significant additional benefit for investors seeking a foothold in Europe, though it adds another layer to the legal process.

Your solicitor will guide you through key legal milestones, which almost always include:

- Obtaining a fiscal number: This tax identification number is usually required before you can buy a property or open a local bank account.

- Conducting due diligence: This involves deep legal checks on the property’s title, planning permissions, and any outstanding debts.

- Reviewing the purchase contract: Your solicitor ensures the contract protects your interests and complies with all local laws.

- Registering the title: The final step is officially registering the property in your name at the local land registry.

Demystifying Your Tax Responsibilities

Tax is undoubtedly the most complex aspect of owning property abroad. You will almost certainly have tax obligations in two jurisdictions: the country where the property is located and your country of residence. A specialist tax advisor is essential to ensure compliance and structure the investment efficiently.

Key tax concepts you will encounter include:

- Withholding Tax: Many countries deduct a percentage of your rental income at source. The rate varies widely; for non-EU residents in Spain, for example, it is 24% of gross rental income.

- Income Tax: You must declare rental profits in the host country. Each country defines 'profit' differently, particularly regarding deductible expenses.

- Capital Gains Tax (CGT): Upon selling the property, you will likely owe tax on your profit in the host country.

- Double-Taxation Treaties: These are agreements between countries designed to prevent you from being taxed twice on the same income. A good advisor will ensure you leverage any applicable treaty.

For a comprehensive breakdown of fiscal duties, check out our guide to understand property taxes when investing abroad.

Structuring Your Investment for Tax Efficiency

The structure through which you purchase your property can have a substantial impact on your future tax liability. For UK-based investors, buying through a limited company has become a primary strategy for tax efficiency, reflecting a broader shift towards professionalisation in the buy-to-let sector.

Data from Companies House shows over 680,000 limited companies now hold buy-to-let properties, and industry analysis suggests 70-75% of new purchases are made via these corporate structures. For international buyers targeting the UK, this structure offers corporation tax benefits over personal income tax. You can find more detail on this trend over at Liquid Expat Mortgages.

Structuring your international buy-to-let correctly from day one is paramount. Whether it’s using a limited company or another vehicle, the right setup can dramatically reduce your tax burden on both rental income and capital gains. This directly boosts your long-term return on investment. It's a decision that should always be made with professional tax and legal advice tailored to your specific situation.

Financing Your Overseas Property Purchase

Securing the right funding is a critical step in turning an international property ambition into a tangible asset. Along with managing currency movements, it is one of the primary challenges for overseas investors. Understanding your options allows you to structure the purchase in a way that aligns with your financial position and risk tolerance.

Most investors pursue one of three main financing routes. Each has distinct advantages and disadvantages, making a thorough evaluation essential.

Key Financing Options for Overseas Investors

The most common methods for funding an overseas property purchase involve leveraging existing assets or obtaining finance in the target country.

- Releasing Equity from Your Home: For many, this is the most straightforward route. By remortgaging a primary residence, you can extract a lump sum to purchase the overseas property outright. This avoids the complexities of a foreign mortgage application and strengthens your negotiating position as a cash buyer.

- Applying for a Local Mortgage: Obtaining a mortgage from a bank in the target country can be a prudent move. Local lenders have deep knowledge of their property market and legal procedures. However, as a non-resident, expect more stringent checks, higher deposit requirements—often 30-40%—and potentially higher interest rates.

- Using a Specialist International Lender: A number of banks and specialist brokers focus on providing mortgages specifically for non-residents. They typically operate across multiple countries and are equipped to handle the cross-border complexities. They can be an invaluable resource for your international buy-to-let purchase.

A crucial factor is the interest rate environment. For example, recent Bank of England data shows a dynamic UK market where buy-to-let lending saw 49,590 new loans totalling £8.8 billion in a single quarter. With mortgage rates dropping, affordability has improved, making such markets more attractive for financed purchases. Explore more on these trends in the latest UK mortgage lending statistics.

Managing Currency Risk

Once funding is planned, the next significant challenge is currency risk. Exchange rates are in constant flux, and this volatility can have a major impact on both your initial purchase cost and ongoing rental income.

For example, if you agree to buy a €300,000 property in Spain when the exchange rate is £1 = €1.15, the purchase price is approximately £260,870. If the Pound weakens to £1 = €1.12 by the completion date, the property now costs £267,857—an increase of over £7,000. The same risk applies to your rental income when converted back to your home currency.

Fortunately, practical tools exist to manage this risk.

- Forward Contracts: This is a simple yet powerful tool offered by currency specialists. It allows you to lock in an exchange rate today for a transaction that will happen in the future, removing uncertainty and protecting you from adverse market movements during the sale process.

- Foreign Currency Account: Opening a bank account in the local currency is a sensible strategy. It allows you to collect and hold rental income without immediate conversion, giving you the flexibility to exchange funds when the rate is favourable.

Structuring your finances correctly is as important as finding the right property. For a more detailed breakdown, see our guide on financing an investment property. By planning ahead, you can protect your capital and ensure your international investment is financially sound from the start.

Your International Property Buying Checklist

Translating theory into a successful purchase requires a structured, methodical process. This checklist consolidates the core principles of this guide into a clear, actionable plan. Following these steps will help you navigate the complexities of an international buy to let with confidence, ensuring all bases are covered and costly errors are avoided.

Stage 1: The Strategy and Preparation Phase

Before reviewing any property listings, you must define your objectives. This initial stage is about setting clear goals and assembling the professional team to help you achieve them. Rushing this phase is a common mistake that often leads to a poor investment outcome.

- Define Your Investment Goals: Are you targeting high rental yields for immediate cash flow, long-term capital growth, or a balanced combination? Your answer will direct you towards suitable markets from the outset.

- Establish a Detailed Budget: Calculate your total available capital. This must include not only your deposit but also an additional 10-15% of the property's price to cover acquisition costs like taxes, legal fees, and administrative charges.

- Assemble Your Professional Team:

- Independent Local Solicitor: Essential for legal due diligence and interpreting foreign contracts.

- Specialist Mortgage Broker: Your guide for navigating non-resident financing options.

- Tax Advisor: Crucial for understanding your obligations in both your home country and abroad, and for structuring your purchase intelligently.

- Currency Specialist: To manage exchange rate risk and protect your budget during the transaction.

Stage 2: Market Research and Due Diligence

With your strategy established, the next step is to identify the right market and property. This phase must be driven by data-driven analysis, not emotion. Thorough due diligence is your primary defence against a poor investment.

- Shortlist Target Countries and Cities: Based on your goals, begin analysing markets. Evaluate economic stability, rental demand drivers, and regulations regarding foreign ownership.

- Conduct In-Depth Property Analysis: For any promising property, calculate the realistic net rental yield after all costs have been deducted. Investigate local property price trends using official data from sources like a country’s land registry. Do not rely solely on agent projections.

- Perform On-the-Ground Checks: If possible, visit the location. If not, leverage local contacts (such as a reputable buying agent) to verify the property’s condition, the neighbourhood’s appeal, and actual tenant demand.

A successful international buy-to-let is rarely about discovering a hidden gem. It is about methodically verifying that a seemingly good opportunity withstands intense scrutiny. The numbers must work after all costs, taxes, and potential vacancies are factored in.

Stage 3: The Transaction and Post-Purchase Phase

Once you have identified a property that meets your criteria, you enter the transaction stage. Precision and clear communication with your team are vital for a smooth closing and efficient setup.

- Make a Formal Offer: Submit your offer through the correct legal channels, guided by your local agent and solicitor.

- Finalise Financing and Legal Checks: While your mortgage broker secures funding, your solicitor will complete the final due diligence, including title searches and reviewing the final contract.

- Complete the Purchase and Register Title: This is the final step of the acquisition. You will sign the final deeds, and your solicitor will ensure the property is officially registered in your name with the relevant authorities.

- Set Up Property Management: Engage a reputable local letting agent. They will find tenants, manage the property day-to-day, and ensure compliance with all local landlord regulations. This final step turns your asset into a functioning, income-generating investment.

Frequently Asked Questions

Entering the world of international property investment invariably raises questions. This section addresses some of the most common queries from aspiring global landlords, providing clear, practical answers to aid your decision-making.

Which Are the Best Countries for a First-Time International Investor?

For a first-time investor, it is prudent to focus on countries with straightforward legal systems for foreign buyers, stable economies, and proven rental demand. Markets such as Portugal, Spain, and parts of the UAE (particularly Dubai) are popular because they have transparent, well-established processes for non-resident owners.

The UK also remains a top choice due to its legal clarity and robust rental market, especially in high-yield cities outside London. The key is to balance growth potential with ease of entry. You want a market where the rules are clear and professional support is readily available.

How Do I Manage an Overseas Property from My Home Country?

Remote management is entirely feasible with the right team on the ground. The most effective solution is to hire a professional, local property management company to act as your representative.

These firms handle the entire rental process, including:

- Finding and thoroughly vetting potential tenants.

- Collecting monthly rent and managing accounts.

- Handling all routine maintenance and emergency repairs.

- Ensuring the property remains compliant with local landlord-tenant laws.

They typically charge a fee, often between 8% and 12% of the monthly rent, but their local expertise is invaluable. This service saves significant time, reduces legal risks, and ensures your international asset is properly maintained and profitable.

What Is a Realistic Starting Budget for an International Property?

A realistic budget must account for far more than the advertised price. A range of transaction costs can add up quickly. A safe rule of thumb is to budget an additional 10% to 15% of the purchase price to cover these essential expenses.

These costs typically include legal fees, property registration charges, surveyor fees, and purchase taxes (e.g., stamp duty), which vary enormously between countries. It is also wise to maintain a separate contingency fund, ideally equivalent to 3-6 months of rental income, to cover any void periods or unexpected repairs without financial strain.

How Does a Limited Company Help International Investors?

For investors buying in the UK, using a limited company has become a core strategy for tax efficiency. This structure separates the property asset from your personal finances, treating it as a distinct business entity.

The primary advantage is that rental profits are subject to UK Corporation Tax, which is often significantly lower than the higher rates of personal Income Tax. Crucially, 100% of mortgage interest can be offset against company profits—a valuable tax relief that has been phased out for individual landlords. This structure is particularly beneficial for higher-rate taxpayers and those planning to build a larger portfolio.

At World Property Investor, we provide the data-driven guides and market analysis you need to invest with confidence. Explore our resources to find your next international buy to let opportunity. https://www.worldpropertyinvestor.com