For UK investors evaluating the Spanish property market, a clear understanding of the mortgage landscape is a critical first step. Currently, mortgage rates in Spain for non-resident investors typically fall within the 3.0% to 4.5% range.

The final rate will, of course, depend on the mortgage product and your personal financial standing. However, a firm grasp of these figures is essential for accurately forecasting key metrics such as rental yields and overall return on investment.

Understanding the Current Spanish Mortgage Landscape

For any UK buyer, securing the right financing is fundamental to a successful property venture in Spain. The market has undergone significant structural change in recent years, shifting from a historical reliance on variable-rate products towards a more balanced environment.

Today, fixed-rate mortgages are far more common, offering the predictability that international investors require. This shift provides welcome stability against the economic fluctuations seen across Europe.

The primary driver of this landscape is the European Central Bank (ECB). Its monetary policy directly influences the Euribor—the benchmark rate to which most variable-rate loans are linked. This is a crucial factor for anyone investing in overseas property and mapping out long-term liabilities.

A Market in Transition

Spain’s mortgage market has a volatile history. After reaching highs of around 5-6% in the mid-2000s, rates entered a prolonged decline, with the average for new loans falling to a record low of just 1.49% in 2021.

As the macroeconomic climate shifted, the annual average rate jumped to 3.75% by 2023. More recently, conditions have stabilised, with rates dipping to 3.04% by late 2024—a figure comfortably below the European average of 3.44%, according to Eurostat data. You can explore further data on this at Statista.com.

This trend reflects a broader market adjustment. Fixed-rate options, which provide a hedge against volatility, now represent a significant portion of new mortgage agreements.

This evolving environment presents both challenges and opportunities. While the era of sub-2% rates is over, current mortgage rates in Spain remain competitive within the Eurozone. This is particularly true in prime coastal markets like the Costa del Sol and the Balearic Islands, where robust rental demand can comfortably offset higher financing costs.

For the astute investor, the key takeaway is this: Spain's mortgage market offers stability through fixed-rate products that were once uncommon. This allows for more precise cash flow forecasting and risk management, which are critical for building a resilient international property portfolio.

To provide a clearer picture, here is a summary of what UK investors can typically expect when seeking a mortgage in Spain.

Spanish Mortgage Rates at a Glance for UK Investors

This table outlines the common mortgage products available to non-residents, along with typical interest rate ranges and Loan-to-Value (LTV) ratios.

| Mortgage Type | Typical Interest Rate Range (Non-Resident) | Typical Loan-to-Value (LTV) | Best For |

|---|---|---|---|

| Fixed-Rate | 3.0% – 4.5% | 50% – 70% | Investors seeking predictable monthly payments and long-term stability. |

| Variable-Rate | Euribor + 0.8% to 2.0% | 50% – 70% | Investors comfortable with rate fluctuations who believe rates will fall. |

| Mixed-Rate | Fixed for 5-10 years, then variable | 50% – 70% | Those wanting short-term predictability with flexibility in the long run. |

These options provide a good degree of flexibility. Whether you prioritise the certainty of a fixed rate or are willing to accept market risk with a variable one, competitive products are available for non-resident buyers.

Fixed vs Variable Mortgages: Choosing Your Strategy

Selecting the right mortgage is a fundamental decision that will define your investment's financial performance for years. In Spain, the choice primarily lies between fixed-rate, variable-rate, and the increasingly popular mixed-rate mortgage. Each functions differently, offering distinct advantages and risks that can be aligned with specific investment objectives.

Understanding how they operate is critical for managing exposure to fluctuating mortgage rates in Spain and maintaining target returns.

The Fixed-Rate Mortgage: The Predictable Anchor

A fixed-rate mortgage is the most straightforward option. The interest rate is locked in for the entire loan term, meaning your monthly repayment remains constant. This acts as a predictable anchor for your investment, simplifying cash flow forecasts and eliminating the risk of rising interest rates.

For long-term investors, particularly in the buy-to-let sector, this stability is invaluable. It allows for the calculation of net rental yield with a high degree of certainty, as the largest ongoing cost is fixed. Historically less prevalent in Spain, fixed-rate deals saw a surge in demand following recent market volatility as investors prioritised security over the potential for lower, but riskier, variable rates.

The Variable-Rate Mortgage: The Market-Tied Vessel

In contrast, a variable-rate mortgage is linked directly to financial markets. The interest rate comprises two parts: the 12-month Euribor (the key European benchmark rate) plus a fixed margin set by the bank. The rate is reviewed periodically—usually annually—and monthly payments adjust up or down based on Euribor movements.

When the Euribor is low, financing costs can be significantly cheaper than a fixed-rate alternative. However, when the European Central Bank raises its base rates, as seen in the 2022-2023 cycle, payments can increase sharply, eroding profitability.

The Spanish market has traditionally favoured variable-rate mortgages, especially during prolonged periods of low interest rates. Research from European economic bodies shows that countries like Spain, with a high proportion of variable-rate products, experience the impact of monetary policy changes more rapidly, affecting household spending and property markets more immediately than in economies dominated by fixed rates.

The Mixed-Rate Mortgage: A Hybrid Solution

The third option, a mixed-rate mortgage, offers a blend of both structures. It provides an initial fixed-rate period, typically for the first five or ten years, before converting to a variable rate for the remainder of the term. This hybrid approach delivers short-to-medium-term stability while leaving the potential to benefit from lower variable rates in the future.

This can be a strategic choice for investors planning to hold a property for a defined period before selling or refinancing. It allows for predictable costs during the initial, and often most critical, phase of the investment.

To assist your decision-making, here is a direct comparison of the three main types of mortgage rates in Spain from an investor's perspective:

| Feature | Fixed-Rate Mortgage | Variable-Rate Mortgage | Mixed-Rate Mortgage |

|---|---|---|---|

| Risk Profile | Low: Insulated from market fluctuations. | High: Directly exposed to Euribor changes. | Medium: Risk is deferred until the fixed period ends. |

| ROI Predictability | High: Costs are known, simplifying yield calculations. | Low: Unpredictable costs make long-term forecasting difficult. | High initially, then Low: Predictable for the fixed term only. |

| Best For | Long-term buy-to-let investors prioritising stable cash flow. | Experienced investors with high risk tolerance who anticipate falling rates. | Investors with a 5-10 year exit strategy or who want initial security. |

The right choice ultimately depends on your personal risk appetite and investment timeline. While variable rates once dominated the Spanish market, the recent shift towards fixed rates signals a more mature, risk-aware approach among international property investors.

Key Factors That Influence Spanish Mortgage Rates

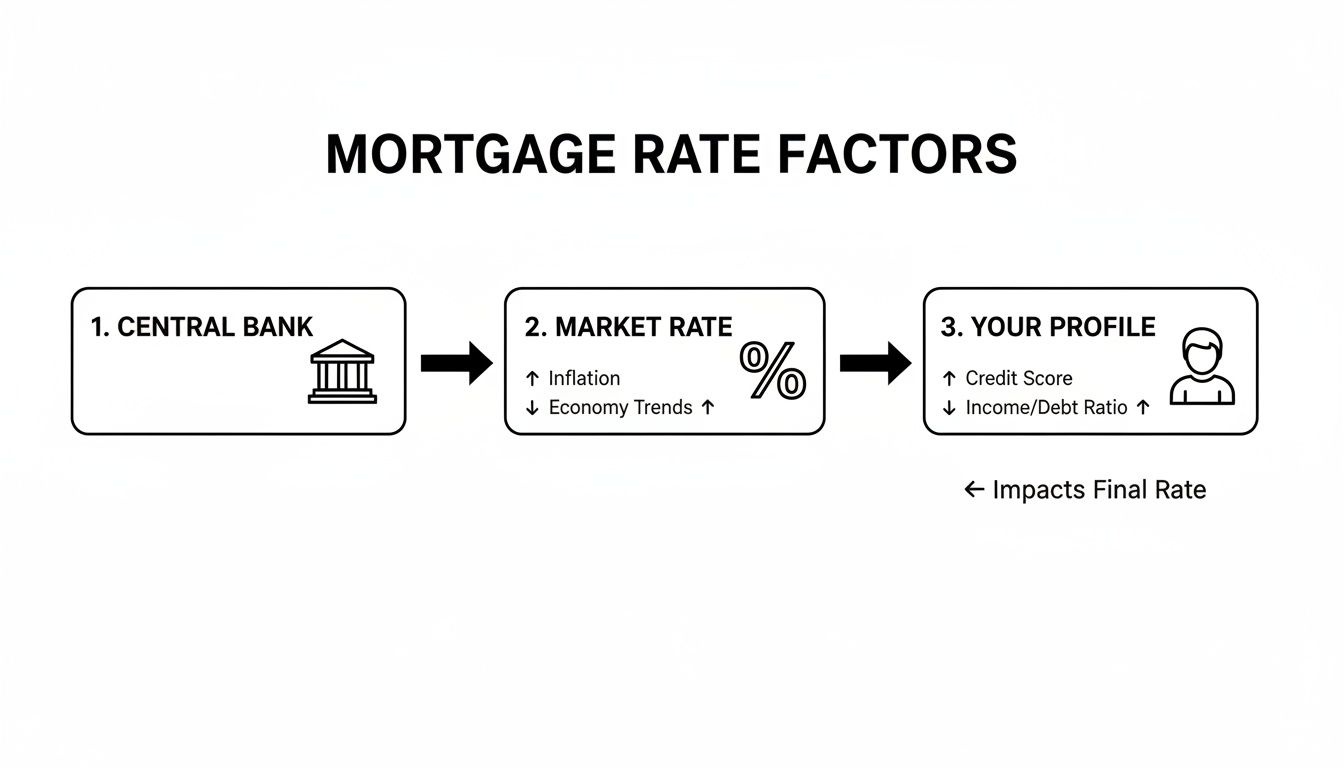

To make an informed investment, it is essential to understand what drives mortgage rates in Spain. The rate offered by a bank is the outcome of macroeconomic forces, the commercial objectives of Spanish lenders, and your own financial profile.

At the highest level, the European Central Bank sets the monetary policy. In the middle, Spanish banks compete for business. At the base is the applicant. Each layer plays a crucial role in shaping the final interest rate.

The European Central Bank Sets the Tone

The single largest influence on Spanish mortgage rates is the European Central Bank (ECB). The ECB's mandate is to maintain price stability across the Eurozone, using its key interest rates as its primary policy tool. When the ECB raises rates to combat inflation, borrowing becomes more expensive for Spanish banks.

These costs are inevitably passed on to borrowers. Any change in ECB policy will ripple through to new mortgage offers in Spain, even with a slight time lag. This is the macro force that dictates the overall direction of lending.

The policy pivot in 2022 serves as a clear example. With inflation soaring, the ECB implemented aggressive rate hikes. This sent the average cost of new Spanish mortgages to 3.74% by 2023. By late 2024, the situation had inverted, with Spanish mortgages averaging 3.04%—a significant 0.40% below the wider European average of 3.44%. This competitive advantage has been a key draw for UK investors targeting holiday lets, where yields of 6-8% are achievable in established markets like Alicante and Malaga. You can discover insights on mortgage rate data from Statista to see these trends.

The Euribor Effect and Bank Margins

While the ECB sets the climate, the direct benchmark for most variable-rate mortgages in Spain is the Euribor (Euro Interbank Offered Rate). This is the rate at which major European banks lend to one another and it tracks the ECB's policy rate closely. A variable-rate loan is priced as ‘Euribor + the Bank’s Margin’. The margin is the fixed percentage the bank adds to make its profit.

This is where individual bank strategies come into play. Lenders in Spain compete by adjusting their margins. They also apply a small risk premium based on their assessment of the market and the applicant. For non-resident investors, this premium is often slightly higher to account for perceived additional risks, such as currency fluctuations or different legal jurisdictions. This is one of several costs to factor in; our guide on understanding property taxes in Spain provides a comprehensive overview.

Your Personal Profile and LTV Ratio

Finally, the part of the equation you control directly is your own financial standing. Lenders will conduct a thorough assessment of your financial profile to determine your risk level. Two factors are paramount:

- Creditworthiness: Spanish banks will scrutinise your income stability, existing debt levels, and credit history. A well-documented financial profile with a low debt-to-income ratio signals a lower risk and will secure more favourable rates.

- Loan-to-Value (LTV) Ratio: This is the percentage of the property’s price being borrowed. A lower LTV—meaning a larger deposit—significantly reduces the bank’s risk. Providing a 40% deposit (a 60% LTV) instead of the typical non-resident minimum of 30% (a 70% LTV) will almost always result in a better interest rate.

Investor Takeaway: You have direct control over this final factor. By preparing a robust application, saving for a larger deposit, and maintaining a healthy credit profile, you can actively influence the mortgage rate you are offered, potentially saving thousands over the lifetime of the loan.

Navigating the Mortgage Process as a UK Investor

For UK investors, it is crucial to recognise that securing a mortgage in Spain differs from the process in the UK. Spanish lenders view non-resident applicants through a more stringent lens, involving stricter rules and higher requirements. Understanding this from the outset is key to building a strong application and ensuring a smooth property acquisition.

The primary difference relates to the financial assessment. Banks are inherently more cautious with overseas borrowers, which manifests as lower Loan-to-Value (LTV) ratios and more rigorous affordability checks. This directly impacts the upfront capital required and the overall financial structure of your investment.

Key Differences for Non-Resident Applicants

While the principles of lending are universal, Spanish banks apply specific safeguards to non-resident applications. You should anticipate a higher threshold than a local buyer would face.

The most significant hurdle is typically the deposit. A Spanish resident may secure a mortgage for up to 80% of a property’s value, but as a non-resident, you will generally be limited to an LTV of 60-70%. This means a cash deposit of at least 30-40% of the purchase price is required, plus an additional 10-15% to cover taxes and fees.

Affordability checks are also stricter. Spanish lenders will require that your total existing debt repayments—including your UK mortgage and the new Spanish loan—do not exceed 30-35% of your net monthly income. This debt-to-income ratio is a critical metric, and it is advisable to calculate it before beginning your property search.

A common error for UK investors is underestimating the total capital required. For a €300,000 property, a non-resident should budget for a deposit of €90,000 (at 70% LTV) plus approximately €36,000 for fees and taxes. This brings the total upfront cash requirement to around €126,000.

The visual below illustrates how macroeconomic factors, bank rates, and your personal financial health combine to determine your final mortgage rate.

The key takeaway is that while you cannot control ECB policy, you can absolutely control your own financial profile. A stronger application provides real leverage for negotiating better terms.

Essential Documentation and Associated Costs

Organising your paperwork is a critical part of the process. Spanish banks require a comprehensive file to verify your identity, income, and credit history. Preparing this documentation in advance will significantly accelerate the application.

Typical Documentation Required:

- NIE Number: Your Spanish tax identification number is non-negotiable.

- Proof of Income: Your last three to six months of payslips, your most recent P60, and your last two years of tax returns (e.g., SA302 forms if self-employed).

- Employment Verification: A letter from your employer confirming your role, salary, and length of service.

- UK Credit Report: A recent report from a major UK agency such as Experian or Equifax.

- Bank Statements: At least six months of statements from your main UK account to show income, expenditure, and savings history.

In addition to the interest rate, you must budget for several one-off costs. These "closing costs" can be substantial and must be paid from your own funds; they cannot be rolled into the mortgage loan.

Typical Mortgage Costs for a Non-Resident Buyer in Spain

| Fee or Tax | Typical Cost (as % of property price or loan amount) | Description |

|---|---|---|

| Property Valuation Fee (Tasación) | 0.1% – 0.2% of property value | A mandatory valuation by a bank-approved surveyor to confirm the property's worth. |

| Notary Fees | 0.3% – 0.5% of property price | The official cost for the public notary to witness and formalise the property deeds. |

| Land Registry Fees (Registro) | 0.2% – 0.4% of property price | The fee to register your ownership of the property in the official Land Registry. |

| Stamp Duty (AJD Tax) | 1.0% – 1.5% of the loan amount | Actos Jurídicos Documentados is a tax on legal documents, payable on the mortgage deed. |

| Mortgage Opening Fee | 0% – 1% of the loan amount | A fee charged by some banks for setting up the mortgage, though many now waive this. |

| Gestoría (Admin Services) | €300 – €500 (fixed fee) | A professional service that handles administrative tasks, tax payments, and registrations. |

These figures are a reliable guide but can vary by region and lender. Factoring them into your budget from day one prevents unforeseen issues and ensures you have sufficient capital to complete the purchase. For a more detailed analysis, see our guide on financing an investment property.

Actionable Steps to Secure a Better Mortgage Rate

Understanding how mortgage rates in Spain are determined is the first step. The next is implementing a strategy to secure the best possible terms. While market conditions set the baseline, your preparation can significantly reduce long-term borrowing costs. This requires forward planning and moving beyond simply accepting the first offer presented.

The key is to negotiate from a position of strength, which begins long before you apply. It involves building a robust financial profile, understanding the local lending culture, and identifying the most competitive lenders.

Engage a Specialist Mortgage Broker

For UK investors, this is arguably the single most effective action you can take. Partnering with an independent mortgage broker who specialises in non-resident applications is crucial. A local Spanish bank branch may lack the experience or incentive to handle the complexities of a foreign applicant's finances, whereas a specialist broker manages these cases daily.

These experts have established relationships with a wide range of lenders, including those without a high-street presence that offer competitive rates to foreign buyers. They know how to present your financial profile in the most favourable light, navigate language barriers, and access deals not available to the general public. Their fee is almost always a sound investment, repaid through the savings from a lower interest rate.

Prepare Your Financial Profile in Advance

Spanish lenders place a high value on financial stability and a clean credit history. Begin organising your documents and finances at least six months before you intend to apply. This provides ample time to enhance your profile and address any potential red flags.

Key areas to focus on:

- Lower Your Debt-to-Income Ratio: Reduce personal loans, credit card balances, and car finance. Lenders require your total monthly debt payments (including the new Spanish mortgage) to be below 35% of your net monthly income.

- Build a Solid Savings History: Your bank statements will be carefully examined. Lenders need to see a consistent pattern of saving and evidence that your deposit was accumulated over time, not from a recent loan.

- Obtain a Clean UK Credit Report: Request your credit file from a major agency like Experian. Review it for any errors or defaults that could hinder your application.

Understand the Power of 'Vinculaciones'

A distinctive feature of the Spanish mortgage market is the concept of vinculaciones. This is where banks offer a discounted interest rate in return for you taking out other financial products with them. This is a standard and legal practice in Spain.

By subscribing to additional products—such as home insurance, life insurance, or a pension plan with the lender—you can often secure a significant rate reduction. The key is to carefully assess whether the cost of these bundled products outweighs the savings on the mortgage.

Always request a clear breakdown from the bank showing the standard rate versus the discounted rate, alongside the annual cost of each linked product. You may find that purchasing your own insurance on the open market is more cost-effective, even with a slightly higher mortgage rate. This analysis is crucial for determining your true costs and being able to calculate the ROI for your real estate accurately.

Market Outlook and Final Takeaways for Investors

The outlook for Spanish mortgage rates is one of cautious optimism, shaped by evolving economic signals. The primary driver remains the European Central Bank (ECB). While the aggressive rate-hiking cycle of 2022-2023 is concluded, a return to the near-zero rates of the preceding decade is unlikely. The ECB's commentary indicates a vigilant stance on inflation, suggesting that any future rate cuts will be gradual. Investors should anticipate a period of stability, with rates settling at a more historically normal level.

Navigating the New Normal

This environment presents an interesting dynamic. Many fixed-rate mortgages secured at historical lows are due for renewal in the coming years, which will create a delayed ripple effect. Data from European economic bodies suggests the average rate paid by existing mortgage holders will likely continue to rise, even as rates for new mortgages stabilise or dip slightly.

For new investors, this creates a nuanced picture. While headline rates are no longer at historic lows, the fundamentals of Spain's property market remain exceptionally strong, particularly in established tourist destinations and emerging secondary cities.

Investor Takeaway: The strategic focus has shifted. It is less about securing once-in-a-generation low rates and more about obtaining a competitive rate that aligns with a robust investment case. Strong rental demand in markets such as the Costa Blanca and the Balearics means yields are often sufficient to comfortably service current financing costs.

Final Thoughts for UK Investors

Overall, Spain remains a compelling market for UK property investors who conduct thorough due diligence. The era of ultra-cheap debt may have passed, but opportunities for capital appreciation and reliable rental income persist.

Key takeaways for your strategy:

- Plan for Stability, Not Steep Drops: Base your financial models on current mortgage rates in Spain. Factor in the potential for modest future decreases but do not make this the foundation of your investment case. Building a buffer into your calculations is prudent risk management.

- Focus on Market Fundamentals: Long-term success will depend more on the property's location, local rental demand, and asset quality than on minor fluctuations in interest rates. Spain’s enduring appeal to tourists and expatriates provides a solid basis for rental income.

- Preparation is Your Best Leverage: A strong financial profile, a substantial deposit, and an expert broker are your most powerful tools for securing favourable mortgage terms in the current climate.

For the well-prepared investor, the Spanish property market continues to offer a rewarding combination of lifestyle benefits and sound financial returns.

Frequently Asked Questions

When approaching the Spanish property market from the UK, it is natural to have questions about the different system. Here are clear answers to the most common queries to help you plan your investment with confidence.

Can I Get a Mortgage in Spain as a UK Resident After Brexit?

Yes, UK citizens can still obtain mortgages in Spain without significant new obstacles. The primary change is that you are now classified as a non-EU resident.

This is a standard process for Spanish banks, but it means they will assess your application with greater scrutiny. Expect stricter affordability checks and lower Loan-to-Value (LTV) ratios, typically capping the loan at 60-70% of the property's value. You will need to provide more detailed documentation, including comprehensive proof of income and a full UK credit report. Brexit has not closed the door; it has simply altered the administrative requirements.

What Is Euribor and How Does It Affect My Spanish Mortgage?

Euribor (the Euro Interbank Offered Rate) is the benchmark rate that European banks use for interbank lending. It forms the basis for almost every variable-rate mortgage in Spain.

If you have a variable-rate mortgage, your interest rate is quoted as ‘Euribor + a bank margin’. For example, if the 12-month Euribor is 3.5% and the bank's margin is 1.0%, your total payable rate is 4.5%. As Euribor fluctuates, your monthly payments will be adjusted, typically on an annual basis. This represents the key risk of variable-rate products and is why many investors now prefer the certainty of fixed rates.

Euribor’s direct link to your monthly payments makes it essential to monitor. Announcements from the European Central Bank (ECB) provide the best indicators of its future direction.

How Much Deposit Do I Need as a Non-Resident?

As a non-resident investor, you must prepare for a larger deposit than a Spanish resident. Banks in Spain will typically lend a maximum of 60-70% of the property’s purchase price or its official valuation—whichever is lower.

This means your minimum cash deposit must be 30-40%. In addition, you must cover purchase taxes and fees, which typically amount to another 10-15%. A prudent investor should plan to have 40-55% of the property's value available in cash to cover all costs comfortably. For a more detailed breakdown, our beginner's guide to real estate investing is a useful resource.

Is It Better to Use a Mortgage Broker in Spain?

For most UK investors, the answer is yes. Engaging an experienced, independent mortgage broker is almost always the most effective strategy. A good broker specialising in non-resident clients offers several advantages over approaching a high-street bank directly.

They have established relationships with an extensive network of lenders, including niche banks that offer competitive products for foreign buyers but may not have a public presence. They also manage language barriers, understand how to present UK-based income to satisfy Spanish underwriters, and can structure your application to maximise its chance of approval at a favourable rate.

At World Property Investor, we provide the data-driven guides and market analysis you need to invest with confidence. Explore our resources to compare global markets and find your next opportunity.

https://www.worldpropertyinvestor.com