At its core, property investment is a straightforward discipline: you acquire a property not for personal occupation, but to generate a financial return. This return is derived from two primary sources: the rental income collected from tenants and the long-term increase in the property's value. Understanding this dual dynamic of consistent rental income (cash flow) and long-term capital appreciation is the foundational principle for building a successful portfolio.

Why Real Estate is a Cornerstone of Wealth Creation

Unlike equities or bonds, which can be abstract, property is a tangible, physical asset. For generations, it has proven to be one of the most reliable methods for building wealth precisely because of its unique blend of income and growth. This powerful combination is utilised by everyone from first-time investors to global financial institutions.

The first pillar is cash flow. For a rental property, the income from tenants is structured to cover the mortgage, maintenance, and other operational costs. Any surplus represents a net profit—a predictable income stream.

The second is capital appreciation. Over time, property values tend to rise, driven by fundamental economic factors such as inflation, population growth, and housing demand. For example, data from the Office for National Statistics (ONS) shows that UK average house prices consistently trend upwards over the long term, demonstrating resilience even during periods of market fluctuation.

Accessing the Property Market

There is a common misconception that property investment is reserved for the ultra-wealthy. While significant capital is required, modern financing and diverse investment strategies have made the market more accessible. Most investors begin by using a mortgage, which allows them to leverage a smaller deposit to control a much larger, more valuable asset.

Real estate's core appeal lies in its tangibility and fundamental demand. People will always need a place to live, creating a durable and resilient foundation for investment that is less susceptible to short-term market sentiment.

Key Benefits for a Beginner Investor

Entering the property market can feel daunting, but the long-term fundamentals are compelling. Here are the core advantages for a new investor:

- Inflation Hedge: As the cost of living increases, so do rents and property values. This allows your investment to keep pace with, or even outperform, inflation.

- Leverage: You can use borrowed capital (a mortgage) to acquire an asset worth substantially more than your initial investment, amplifying your potential returns.

- Tangible Asset Value: Unlike a stock certificate, a property is a physical asset with intrinsic worth. It cannot disappear overnight.

Success in real estate is built on diligent research and strategic planning, not speculation. By exploring the different approaches to property investment, even those starting with modest capital can begin to build a lasting portfolio.

Understanding Core Property Investment Strategies

Before committing capital, it is crucial to understand the fundamental strategies that drive real returns. Successful investing is not about guesswork; it is about selecting a path that aligns with your financial objectives, risk tolerance, and time commitment.

For most new investors, three principal routes dominate the landscape, each offering a distinct method for building wealth through property.

The Main Investment Approaches

The most common path is buy-to-let. This involves purchasing a property with the specific intention of letting it out to tenants. This strategy is a long-term endeavour, aiming to generate a steady rental income that covers your mortgage and operational costs, while the property’s value appreciates over time.

In contrast, property flipping (buy-to-sell) is focused on short-term capital gains. An investor acquires a property—often one that is undervalued or requires modernisation—improves it through renovation, and then sells it for a profit. This requires a keen understanding of market value and refurbishment costs.

A third, more passive option exists for those who want exposure to the property market without the responsibilities of being a landlord: Real Estate Investment Trusts (REITs). These are companies that own and operate large portfolios of income-generating properties, such as apartment blocks, commercial offices, or shopping centres.

Buying shares in a REIT is akin to acquiring a small stake in a large, diversified property portfolio. It is highly liquid and entirely passive, making it a suitable entry point for beginners with less capital, though it offers no direct control and returns are correlated with stock market performance. You can learn more about how to find undervalued properties in hot markets in our detailed guide.

Comparing Core Real Estate Investment Strategies

| Strategy | Primary Goal | Typical Time Horizon | Capital Requirement | Key Risk Factor |

|---|---|---|---|---|

| Buy-to-Let | Steady rental income & long-term growth | 5-10+ years | Medium to High | Tenant vacancies or defaults |

| Property Flipping | Short-term capital gains | 3-12 months | High | Misjudging renovation costs or market shifts |

| REITs | Passive income (dividends) & diversification | Flexible | Low | Stock market volatility |

Getting to Grips with the Numbers

To analyse any deal effectively, you must understand the language of property investment. Key metrics allow you to compare opportunities objectively and forecast a property's potential performance.

Here are three essential concepts for any beginner:

- Gross Rental Yield: This is the simplest calculation, showing a property’s income potential before any expenses are deducted. It is calculated by dividing the annual rent by the purchase price.

- Net Rental Yield: This metric provides a more realistic view by accounting for operational costs such as insurance, maintenance, and management fees. You subtract these annual costs from the rent before dividing by the purchase price.

- Return on Investment (ROI): This is the ultimate measure of performance because it focuses on the return generated by your actual cash investment (your deposit and acquisition costs), not the property's total value. It demonstrates precisely how effectively your capital is working for you.

In simple terms, rental yield is the annual return you make from your property through rent, expressed as a percentage of its value. It is the most direct way to measure how effectively your asset is generating income.

Why Residential Property is a Strong Starting Point

For new investors, the sheer number of options can be overwhelming. The market is vast, from industrial warehouses to commercial offices. However, residential property presents a logical and powerful place to begin.

The reason is simple: it is driven by one of the most stable forces in any economy—the fundamental human need for shelter.

This unwavering truth creates a structural demand that is far less vulnerable to the cyclical trends affecting other asset classes. A business may downsize its office space during an economic downturn, but individuals and families will always require a home. This ensures a consistent and growing pool of potential tenants.

The Power of Supply and Demand

In many established markets, the demand for housing consistently outstrips supply. Chronic housing shortages are a well-documented issue across many developed nations, putting long-term upward pressure on both rental rates and property values.

For a new investor, this dynamic is incredibly valuable. It means you are investing in an asset where the underlying demand is not just stable but is often growing, supported by demographic trends like population growth and household formation. You are not speculating; you are tapping into a genuine, long-term need.

Choosing residential property for your first investment isn’t just a popular decision; it’s a strategic one backed by powerful, long-term economic and demographic fundamentals. This stability provides an essential buffer against market volatility.

A Market Dominated by Real Need

The data supports this thesis. For anyone exploring UK real estate, residential property overwhelmingly dominates the landscape. In a recent year, residential assets accounted for approximately 79.5% of the total UK real estate market revenue, making it by far the largest and most significant property type.

The broader market is forecast to grow substantially, with the individual household segment projected to expand faster than any other. These figures highlight a clear structural imbalance: a large and growing population chasing a limited supply of homes. You can discover more insights about UK market trends and forecasts here.

This is significant because it reflects a market driven by genuine need rather than pure speculation. While commercial property performance is closely tied to business confidence, the residential sector is sustained by life events—people moving for jobs, starting families, or seeking better schools. This provides a resilient foundation for anyone beginning their real estate journey.

How to Analyse a Property Investment Deal

With a clear strategy and a target market in mind, it is time to move from theory to practice. Analysing a potential property investment—a process known as due diligence—is where your success is truly decided. It is a systematic method for uncovering a property's real potential and identifying risks before you commit capital.

A professional investor never relies on emotion. Instead, they focus on the numbers and the underlying market fundamentals. Your goal is to build a clear, data-driven case for why a specific property will deliver the returns you expect, starting with its ability to generate positive cash flow.

Researching the Local Market

Before viewing a property, your analysis must begin at the macro level. A high-quality flat in a declining neighbourhood is a poor investment. You must be certain that the local area has the economic drivers to support long-term rental demand and capital growth.

Key indicators of a strong market include:

- Employment Growth: Look for areas with a diverse job market and announcements of new corporate investment. A growing workforce means more potential tenants.

- Infrastructure Investment: Are new transport links, schools, or public amenities planned? These can significantly boost an area's desirability and property values.

- Population Trends: Is the local population growing? Data from bodies like the ONS in the UK can reveal demographic shifts that signal rising housing demand.

- Vacancy Rates: Low vacancy rates (the percentage of empty rental units) indicate strong tenant demand, giving landlords greater pricing power.

Conducting Your Property Viewing Checklist

Once you have confirmed the area is robust, it is time to assess the specific property. A viewing is a detailed inspection designed to identify potential costs that could erode future profits.

Pay close attention to high-cost items: the roof, boiler, windows, and any signs of structural issues like major cracks or damp. These potential expenses must be factored into your financial calculations. For a deeper dive, check out our guide on how to determine a property's investment potential.

Calculating Your Cash Flow

This is the most critical part of your analysis. A property’s cash flow is the money remaining after all operating expenses have been paid from the rental income. Positive cash flow means the property pays you each month; negative cash flow means you must subsidise it.

To create a basic cash flow forecast, sum all estimated monthly expenses:

- Mortgage Repayment: The principal and interest payment.

- Property Taxes: Such as Council Tax in the UK.

- Insurance: Landlord and building insurance are essential.

- Maintenance & Voids: A crucial buffer. A common rule of thumb is to set aside 5-10% of the monthly rent for unexpected repairs and for periods when the property is untenanted.

- Letting Agent Fees: If you plan to use a management service, include this cost.

Subtract this total from the expected monthly rent. If the number is positive, you have a potentially viable investment.

A property that generates positive cash flow pays for itself while you benefit from long-term capital appreciation. This is the foundation of sustainable real estate investing for beginners.

Understanding broader market performance provides valuable context for your deal analysis. For instance, data from major economic bodies shows UK all-property total returns are forecast to average around 8% per annum over the next five years. While projections are not guarantees, this helps situate your specific deal within the wider economic landscape. You can discover more about UK real estate market forecasts and commentary.

Comparing Established and Emerging Property Markets

Deciding where to invest is a critical strategic choice. The global property market can be broadly divided into two categories: established markets and emerging markets. This choice must align with your financial goals and, just as importantly, your risk tolerance.

Established markets—such as London, New York, or Tokyo—are defined by their stability, transparent legal systems, and high liquidity. For an investor who prioritises security, they offer a sense of reliability built on decades of performance and strong economic foundations. This stability, however, often comes at a premium, leading to higher prices and compressed rental yields.

The Trade-Off Between Stability and Growth

Emerging markets present a different proposition. Cities in countries like Portugal, Greece, or parts of Eastern Europe often offer the potential for much higher capital growth and more attractive rental yields. The strategy here is to invest before widespread development drives prices higher.

However, this potential for higher returns is balanced by greater risks. Currency fluctuations can erode profits, and the legal and regulatory frameworks can be less predictable. Political or economic instability can also impact these markets more severely than mature economies. Our guide on the top 7 emerging property investment markets explores specific locations in detail.

The core decision for a global investor is balancing the reliable, steady returns of an established market against the higher potential rewards—and higher risks—of an emerging one. Diversification across both can create a more resilient, balanced portfolio.

A Real-World Comparison

To illustrate, consider the UK. London is a classic 'blue-chip' property location, offering exceptional stability and relentless tenant demand, but yields are often compressed by high property prices.

In contrast, strong regional cities like Manchester and Birmingham have demonstrated characteristics of emerging markets within a mature economy. For a beginner, targeting these areas can significantly improve initial rental yields and provide excellent diversification.

According to data from local housing authorities, between early 2020 and mid-2025, Manchester house prices increased by approximately 28.5%, while Birmingham saw a rise of roughly 27.8%. Over the same period, London prices climbed by a more modest 11%.

As of mid-2025, average rental yields were reported at around 7.3% in Manchester and 7.1% in Birmingham, compared to just 5.4% in London. You can explore more on UK residential market trends on JLL.com.

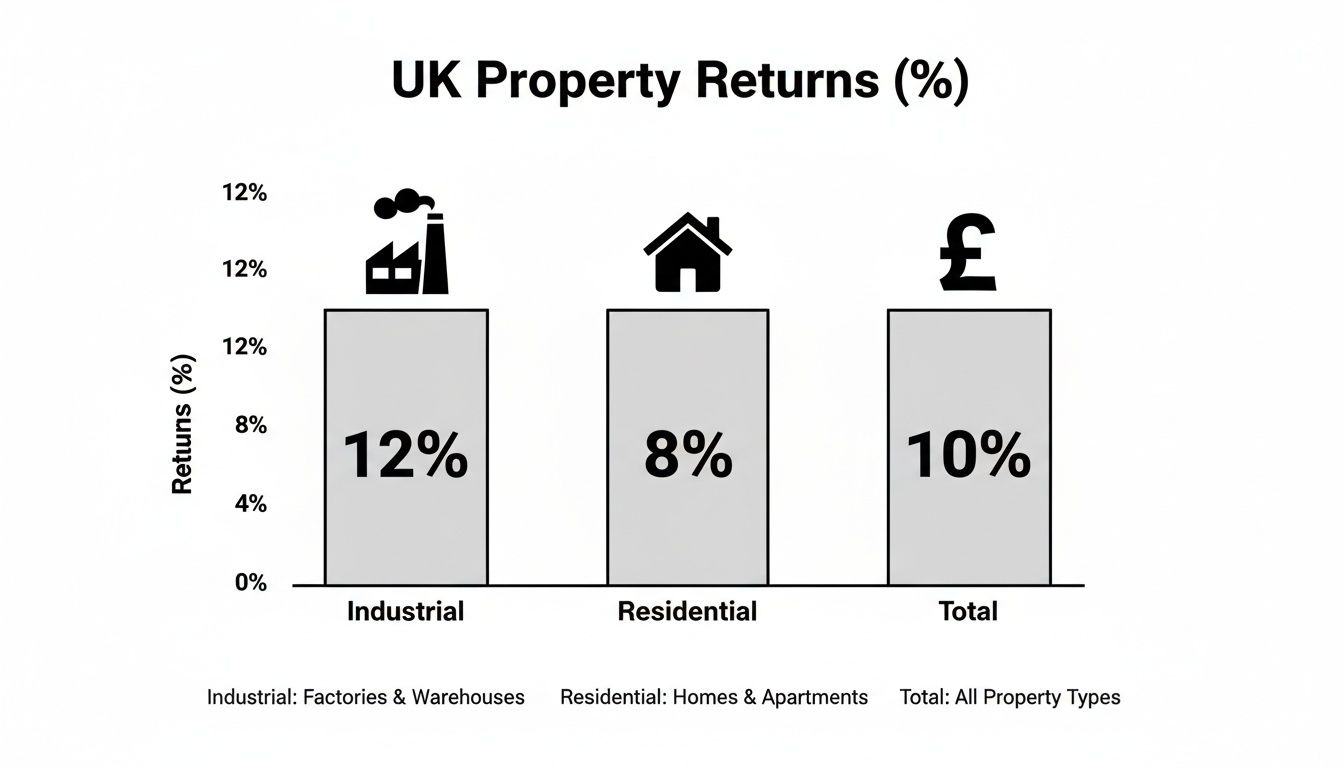

This data shows that while residential property delivers strong, stable returns, other sectors like industrial can sometimes offer higher performance. This underscores the importance of understanding the whole market. For beginners, however, the stability and fundamental demand of the residential sector remain a powerful and reliable place to start.

Navigating the Purchase Process: Financing and Legal

Understanding investment strategy is one thing; executing a property purchase is another. This practical phase is governed by three critical elements: financing, legal structures, and taxation. Correctly managing these aspects is non-negotiable for protecting your capital and ensuring a profitable return.

Securing the Right Funding

Your first major hurdle is securing appropriate funding. In the UK, this typically involves a buy-to-let mortgage, which differs significantly from a standard residential loan. Lenders will assess the property’s potential rental income as rigorously as your personal finances.

A key metric is Loan-to-Value (LTV), which is the percentage of the property's price the bank will lend. For buy-to-let mortgages in the UK, lenders are cautious, often setting a maximum LTV of 75%. This means you will need a deposit of at least 25% of the purchase price.

Understanding Your Tax Obligations

Tax is an unavoidable cost of property investment and varies significantly between jurisdictions. A misunderstanding of your liabilities can easily render a profitable deal unviable. While professional advice is essential, you must understand the basics yourself.

Key taxes to consider in the UK include:

- Transaction Tax: Stamp Duty Land Tax (SDLT). A surcharge applies to investment properties, adding a significant upfront cost.

- Income Tax: The net profit from rental income is taxable according to your personal income tax band.

- Capital Gains Tax (CGT): When you sell an investment property for a profit, the gain is subject to CGT. Rates for residential property are typically higher than for other assets.

Choosing the Right Ownership Structure

How you own your property has significant implications for both your tax liability and your personal risk exposure. For most beginners, the choice is between buying in your personal name or using a limited company.

Buying personally is the most straightforward route. However, rental profits are added to your personal income, which could push you into a higher tax bracket. Crucially, your personal assets could also be at risk in the event of legal disputes.

Setting up a limited company, often called a Special Purpose Vehicle (SPV), is an increasingly common strategy. It allows for more favourable tax treatment of profits and shields your personal assets from business liabilities.

Purchasing through a company offers distinct advantages. For instance, you can offset 100% of your mortgage interest against rental income for tax purposes—a relief that has been severely restricted for individual landlords in the UK. This structure does, however, come with administrative costs and complexities.

The optimal structure depends entirely on your personal financial situation, your long-term goals, and the specific tax laws of your chosen market. This decision should always be made with tailored advice from a qualified property accountant and solicitor.

Your First Steps to Becoming a Global Property Investor

You have absorbed the core concepts, from analysing deals to understanding market fundamentals. Now is the time to translate that knowledge into confident, decisive action. This is where your journey as a property investor truly begins.

The key is to deconstruct the process into manageable tasks to avoid feeling overwhelmed. By focusing on one step at a time, you can build momentum and make tangible progress towards your first acquisition.

Your First-Year Action Plan

This checklist provides a logical sequence for your journey. Each step builds on the last, creating a solid foundation for your future portfolio.

-

Define Your Goals (Months 1-2): What do you want to achieve? Are you seeking long-term rental income for retirement, or are you targeting faster capital growth? Be specific about your financial targets and time horizon. This clarity will guide every subsequent decision.

-

Build Your Deposit (Months 1-6): Determine the capital required for a 25% deposit, plus purchasing costs such as stamp duty and legal fees. Establish a dedicated savings plan to reach this target. Consistent saving is a non-negotiable prerequisite.

-

Conduct Deep Market Research (Months 3-9): Begin with a broad scope, then narrow your focus. Identify three to five potential cities or regions that align with your goals. Delve into local economic drivers, typical rental yields, and supply-demand dynamics. Our guides on investing in overseas property offer an excellent starting point for this research.

-

Assemble Your Professional Team (Months 7-12): Success in property is a team effort. Identify and engage with key professionals: a mortgage broker specialising in investment finance, a solicitor with relevant experience, and a reputable local letting agent in your target market.

The transition from learning to doing is the most significant step in any investor's journey. Success is not born from a single grand action, but from the consistent execution of small, well-planned steps.

Ultimately, real estate investing is a long-term discipline built on continuous learning and thorough due diligence. This guide has equipped you with the fundamental knowledge to begin. Your next move is to take that first step, confident that you are building a secure and prosperous future, one property at a time.

Ready to find your next investment? World Property Investor provides the data-driven market analyses and in-depth guides you need to invest with confidence. Explore global opportunities today at https://www.worldpropertyinvestor.com.