For any global property investor, understanding rental yield is the first critical step. It is the core metric that cuts through market noise and provides a clear measure of a property's income-generating performance.

Understanding Your Return On Investment

Think of rental yield as the interest rate on a property investment. A property might generate £1,000 in monthly rent, but this figure is meaningless in isolation. Is that income from a £150,000 flat or a £500,000 house? Rental yield provides the answer, offering a standardised way to measure performance.

It is the great equaliser, allowing for a like-for-like comparison of different assets—whether in an established market like London or an emerging one like Dubai. It strips away headline prices and rental figures to focus on the fundamental return your capital generates.

Gross Yield vs Net Yield

Distinguishing between gross and net yield is crucial, as they tell very different stories about an asset's real-world profitability. New investors often overlook this distinction.

- Gross Yield: This is the simple, headline figure often seen in marketing materials. It is calculated before any operating costs are deducted, serving as a quick, initial measure of a property's raw income potential.

- Net Yield: This is the figure that impacts your financial position. It accounts for all operational expenses associated with being a landlord, such as maintenance, insurance, management fees, and potential void periods.

Relying solely on gross yield is a common error that leads to over-optimistic financial forecasts. The net yield provides a far more realistic picture of the actual cash flow you can expect.

A property's true performance is only revealed when you move past the optimistic gross yield and calculate the net yield. The difference between the two is where your profit is either made or lost.

To provide context, data from the Office for National Statistics (ONS) shows that while average gross rental yields in the UK can appear attractive, the net return is invariably lower once taxes, repairs, and fees are factored in. This is a critical differential for any buy-to-let investor's financial modelling.

This difference is fundamental to accurately calculating the return on investment for any real estate asset.

Calculating Gross And Net Rental Yield

Understanding the theory is one thing; applying it is another. For any serious investor, calculating both gross and net rental yields is a fundamental skill. This is the process that allows you to analyse a deal and assess its true financial performance.

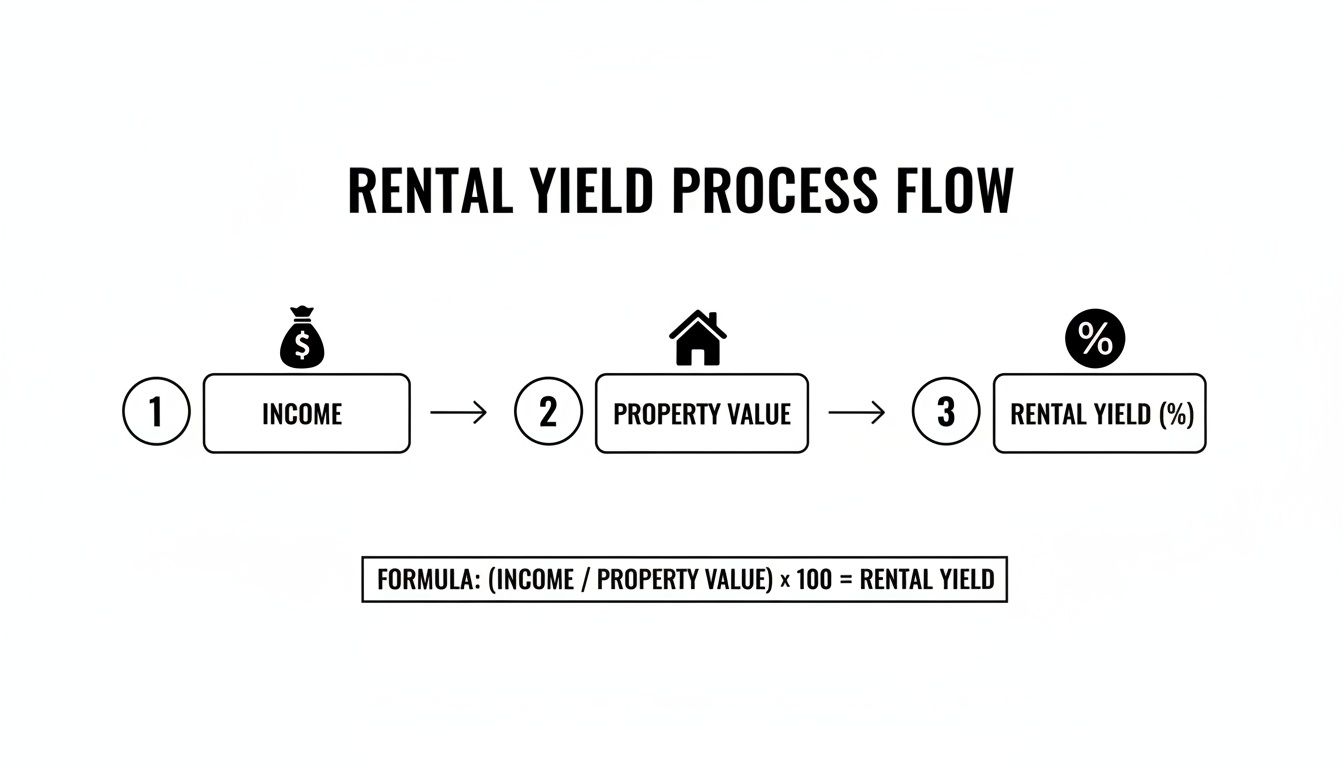

The calculation itself is straightforward, combining a property's rental income with its value to produce a clear percentage. This diagram illustrates the simple flow from core data to the final yield figure.

The calculation connects the income a property generates to its market value, providing a standard metric for performance. Mastering this is key to comparing different investment opportunities on a level playing field.

The Quick Glance: Gross Yield Calculation

Gross rental yield is the ideal tool for an initial assessment. It provides a high-level, unfiltered view of a property's income potential, enabling you to sift through multiple listings quickly without becoming mired in detailed expense analysis.

Think of it as the first filter to eliminate obvious underperformers.

The formula is simple:

(Annual Rental Income / Property Purchase Price) x 100 = Gross Rental Yield (%)

Let's use a real-world example. Imagine you are assessing a flat in Liverpool with a purchase price of £200,000. The letting agent advises it will achieve a rent of £1,000 per month.

- Calculate Annual Rental Income: £1,000 per month x 12 months = £12,000

- Apply the Formula: (£12,000 / £200,000) x 100 = 6.0%

This property has a gross rental yield of 6.0%. This is a useful headline figure for comparison against other flats in Liverpool or an asset in an emerging market. However, it is an optimistic figure that does not represent your actual profit.

Uncovering The Real Profit With Net Yield

Net rental yield is the metric that matters for financial planning. It paints a far more realistic picture by subtracting all the operating costs that erode your gross rental income.

Calculating your net yield is a non-negotiable step in due diligence and is crucial for forecasting your true cash flow. For a deeper dive, review our complete guide on how to determine a property's investment potential.

The formula for net yield adjusts for these costs:

([Annual Rental Income – Annual Operating Costs] / Property Purchase Price) x 100 = Net Rental Yield (%)

Let’s continue with our £200,000 Liverpool flat. The annual rent is £12,000. Now, we must itemise every operational cost.

These expenses will vary, but a typical list includes:

- Letting Agent Fees: Typically 8-12% of rent. At 10%, this is £1,200.

- Landlord Insurance: Essential protection. Budget £300 per annum.

- Maintenance and Repairs: A prudent rule of thumb is to allocate 1% of the property's value, which is £2,000. This covers everything from minor repairs to major appliance failures.

- Service Charges & Ground Rent: Common for leasehold flats. Estimate £1,500 annually.

- Void Periods: It is prudent to assume the property will be vacant for one month per year. This represents £1,000 in lost rent.

- Mortgage Interest: Crucially, this is only the interest portion of your mortgage payment, not the capital repayment. For this example, assume annual interest payments of £3,500.

Now, let's sum the costs:

£1,200 (agent) + £300 (insurance) + £2,000 (maintenance) + £1,500 (service charge) + £1,000 (voids) + £3,500 (interest) = £9,500 in total annual costs.

With these figures, we can calculate the net yield:

- Calculate Net Rental Income: £12,000 (Gross Rent) – £9,500 (Costs) = £2,500

- Apply the Net Yield Formula: (£2,500 / £200,000) x 100 = 1.25%

The investment now looks entirely different. The appealing 6.0% gross yield has contracted to a more sober 1.25% net yield. This stark contrast demonstrates why relying on headline figures is a critical error. The net yield reveals the true return on the property's operations, providing the clarity needed for an informed investment decision.

What Is a Good Rental Yield In The UK?

Once you have calculated the yield, you must place it in context. An investor assessing a high-growth emerging market might dismiss a 5% yield, while one buying in a prime, stable European capital would view it as a strong return. The number is meaningless without context.

The question is: what constitutes a good rental yield in a market as diverse as the United Kingdom?

There is no single figure. For most parts of the UK, a gross rental yield between 5% and 8% is generally considered strong. However, this should be treated as a benchmark, not a rule. A "good" yield ultimately depends on your investment strategy, risk appetite, and whether you are prioritising immediate cash flow or long-term capital growth.

This is where regional market knowledge becomes essential.

The North-South Divide In UK Rental Yields

It is crucial to recognise that the UK is not a single, homogenous property market. It is a collection of distinct regional markets, each with its own economic drivers. For a yield-focused investor, the most significant trend is the stark contrast between the North of England and the South, particularly London.

Historically, northern cities have delivered significantly higher rental yields. This is due to a simple economic dynamic: property prices are substantially lower relative to achievable rents. This is why cities like Liverpool, Manchester, Leeds, and Glasgow have become prime locations for buy-to-let investors.

In contrast, London and the South East are defined by high property values. While rents are also high in absolute terms, they have not kept pace with the rapid rise in property prices. The result is compressed rental yields, often in the 3-5% gross range.

Recent market analysis illustrates this perfectly. For example, while the UK national average gross yield may sit around 5-6%, this figure masks deep regional variations. Cities like Manchester and Liverpool frequently report gross yields approaching 7-8%, while central London postcodes often struggle to exceed 4%. You can discover more insights about UK rental yields on globalpropertyguide.com.

The Strategic Trade-Off: Cash Flow vs Capital Growth

This regional divide presents investors with a critical strategic choice: pursue high yields for strong, immediate cash flow, or accept lower yields in exchange for the potential of greater long-term capital appreciation?

High-Yield Northern Cities (e.g., Liverpool, Manchester)

- Primary Benefit: Strong monthly cash flow from the outset.

- Mechanism: Lower purchase prices result in smaller mortgage payments relative to rental income, leaving a healthier profit margin.

- Investor Profile: Ideal for those seeking to build a passive income stream, diversify a portfolio, or ensure their assets are financially self-sufficient.

Low-Yield Southern Cities (e.g., London)

- Primary Benefit: Potential for significant long-term capital growth.

- Mechanism: The investment thesis is based on the property's value increasing substantially over time, with the main return realised upon sale.

- Investor Profile: Better suited to high-net-worth individuals or investors with a long-term horizon who are not reliant on immediate rental income.

Choosing a location is about more than finding the highest yield. It is about aligning market characteristics with your financial objectives. A 7% yield in Manchester and a 4% yield in London can both be "good" investments, but for entirely different reasons.

Setting Realistic Expectations

To determine what a good rental yield looks like for you, you must analyse the fundamentals of a specific location. Official sources like local council reports or data from the Office for National Statistics (ONS) provide excellent context on drivers such as population growth, employment rates, and planned infrastructure investment. These factors underpin future rental demand and capital growth.

For instance, a city with a major regeneration project or an expanding university is likely to experience sustained tenant demand, supporting both yields and property values. Conversely, an area with a declining major industry might offer tempting headline yields today but could pose a long-term risk of high void periods and falling property values.

Ultimately, a good rental yield is one that meets your financial targets and is sustainable within its local market. It must provide sufficient cash flow after all costs and, ideally, be located in an area with solid fundamentals that promise stability and growth.

How Global Market Forces Influence Your Yield

No property investment exists in a vacuum. Its performance is linked to a complex web of local, national, and global economic forces that can either enhance your rental yield or compress it. For any international investor, understanding these wider dynamics is essential for gauging the long-term health of a market.

Factors such as economic stability, population trends, and government policy set the stage for a strong rental market. A growing economy creates jobs, attracting new residents who require housing. When this increased demand meets a limited housing supply, rental prices—and therefore yields—are pushed upwards.

Established vs. Emerging Markets: A Comparison of Yields

To see these forces in action, it is useful to compare two different market types: a stable, established economy like Germany and a high-growth, emerging hub like Dubai. Their risk-and-return profiles are distinctly different, which directly impacts investor expectations.

Germany (Established Market)

- Characteristics: Known for its economic stability, robust legal frameworks, and predictable—if slower—growth.

- Yield Profile: Rental yields are typically lower, often in the 2-4% range in major cities like Berlin or Munich. This reflects the market's safety and maturity, which are priced into the high property values.

- Investor Appeal: Attracts risk-averse investors seeking long-term capital preservation and a steady, reliable income stream.

Dubai (Emerging Market)

- Characteristics: Defined by rapid economic and population growth, large-scale infrastructure projects, and more dynamic, pro-landlord regulations.

- Yield Profile: Gross rental yields are significantly higher, often reaching 6-9% or more. Property prices can be more volatile, but they offer a lower entry point relative to potential rental income.

- Investor Appeal: Caters to investors with a higher risk tolerance who are targeting strong immediate cash flow and the potential for faster capital appreciation, accepting the associated market volatility.

This comparison highlights a core investment principle: higher yields often correlate with higher risk. The appropriate choice depends entirely on your personal strategy and financial goals.

Key Macroeconomic Levers to Watch

Several specific macroeconomic factors directly influence your net returns. Monitoring these indicators is a non-negotiable part of due diligence for any serious investor.

A central driver is the interest rate set by a country's central bank, such as the Bank of England. When rates rise, mortgage interest payments increase, directly squeezing your net yield. According to Gov.uk data, a sustained rise in the base rate can significantly impact a leveraged investor's net profit. This is a stark reminder of how sensitive your cash flow is to monetary policy.

For a global investor, understanding the interplay between economic growth, interest rates, and local regulations is paramount. These forces dictate not just the potential yield of a property, but the underlying risk and long-term sustainability of your investment.

Local legislation can also have a profound impact. Tenancy laws that heavily favour tenants can make evictions difficult and limit rental increases, capping your income potential. Likewise, some countries impose restrictions or higher taxes on foreign property owners, which must be factored into your net yield calculation. For more on this, see our article on investing in overseas property.

Finally, analyse the balance between housing supply and employment. A city with a booming jobs market but slow housing construction is a landlord's ideal scenario, creating intense competition for rental properties. Conversely, a market flooded with new developments and a stagnant job market is a major red flag, signalling potential for high vacancy rates and falling rents.

Advanced Metrics Beyond Basic Rental Yield

Once you have mastered gross and net yields, you are ready to analyse investments as professionals do. While net yield measures how efficiently a property generates income, it does not show how hard your personal capital is working for you—especially when a mortgage is involved.

To gain that deeper insight, two other metrics are essential.

The first is your Cash-on-Cash Return. This powerful metric focuses on the return generated on the actual capital you have invested—your deposit, legal fees, and any refurbishment costs. It is arguably the single most important metric for understanding the performance of a leveraged property.

The second is the Capitalisation Rate (Cap Rate). Widely used in commercial real estate, the Cap Rate helps you assess a property's profitability and risk, independent of any financing arrangements.

Understanding Your Cash-on-Cash Return

The Cash-on-Cash Return calculation is vital because it reveals the true power of mortgage leverage. A well-structured mortgage can significantly amplify your returns, and this metric measures that effect precisely.

The formula is:

(Annual Pre-Tax Cash Flow / Total Cash Invested) x 100 = Cash-on-Cash Return (%)

Your annual pre-tax cash flow is your net operating income minus your total mortgage payments for the year (principal and interest). Your total cash invested includes everything you paid out of pocket: your deposit, stamp duty, solicitor fees, and initial repair costs.

Let's compare two identical properties, each with a net yield of 4%.

- Property A: Purchased for £200,000 in cash. Your net income is £8,000 per annum. Your Cash-on-Cash Return is (£8,000 / £200,000) x 100 = 4.0%.

- Property B: Purchased with a £50,000 deposit (your total cash invested) and a mortgage. After annual mortgage costs of £5,000, your cash flow is £3,000. Your Cash-on-Cash Return is (£3,000 / £50,000) x 100 = 6.0%.

The difference is clear. Although both properties have the same 4% net yield, the leveraged asset delivers a much higher return on your invested capital. This is why experienced investors focus on this metric when building a portfolio. You can explore more strategies in our guides on property investment.

Using The Capitalisation Rate for Market Analysis

The Cap Rate provides a way to compare the relative value of different properties or even entire markets, taking financing completely out of the equation. It measures the unleveraged return, focusing only on the property’s income-generating power against its current market value.

The formula is:

(Net Operating Income / Current Market Value) x 100 = Cap Rate (%)

A higher Cap Rate generally indicates higher potential returns but often comes with higher perceived risk—perhaps the property is in a less desirable location or requires significant capital expenditure.

Conversely, a lower Cap Rate is common in stable, prime markets like central London or Berlin. It suggests lower risk and greater security but also lower immediate returns. Investors use Cap Rates to quickly assess if a property appears fairly priced for its income and location, making it a crucial tool for comparing opportunities on an apples-to-apples basis.

Common Mistakes To Avoid When Analysing Yields

Knowing how to calculate rental yields is only half the battle. The real skill lies in identifying and avoiding common analytical pitfalls. A sharp eye for these errors separates a sustainable portfolio from a costly mistake. For global investors, capital protection begins with healthy scepticism and rigorous due diligence.

The most frequent trap is confusing gross and net yield. Developers and estate agents almost always advertise the more attractive gross figure. Relying on this number alone is a recipe for disappointment, as it completely ignores the real-world costs that erode your returns.

Trusting Figures Without Verification

Another classic pitfall is accepting advertised yields without conducting your own independent research. An advertised 7% yield may sound compelling, but it could be based on optimistic rental estimates that do not reflect current local market conditions.

A prudent investor never takes an advertised figure at face value. Always verify potential rental income by checking comparable local listings on major property portals and speaking with independent letting agents in the area.

This independent verification must also extend to operating costs. Underestimating ongoing expenses is a common error. Many new investors fail to budget properly for:

- Void Periods: Assuming 100% occupancy is unrealistic. A conservative budget should always account for at least one month of vacancy per year.

- Maintenance: A major repair, such as a new boiler, can eliminate months of profit. Allocating 1% of the property’s value annually for repairs is a sensible guideline.

- Contingency Funds: Unexpected costs are inevitable. A cash buffer for legal fees or emergency repairs is non-negotiable.

Ignoring Regional Market Dynamics

Finally, a failure to appreciate regional differences can lead to poor investment decisions. Rental yields in the UK, for instance, show stark regional divides. The North West often reports average gross yields of 6%–8%, while Greater London can be as low as 3%–5%.

This north-south divide offers opportunities for investors who prioritise affordable entry points and high rental demand over prestigious postcodes. Data from local housing authorities can reveal emerging hotspots where modest property prices support strong yields. You can find more data on the best UK buy-to-let returns on aspenwoolf.co.uk.

By avoiding these common mistakes—verifying every figure, building a conservative budget, and understanding the local market—you can invest with far greater confidence. It is also vital to understand property taxes in your chosen market, as these can significantly impact your net return.

Your Questions About Rental Yields, Answered

To conclude, let's address some of the most common questions that arise when investors are analysing rental yields.

What Is a Good Net Rental Yield?

There is no single correct number, as a “good” yield is relative to the market and your investment strategy.

However, as a general guideline for a standard UK buy-to-let, a net rental yield between 3% and 5% is widely considered a solid, sustainable return. In higher-risk emerging markets, an investor would expect this figure to be 6% or higher to compensate for potential volatility.

The most important criterion is that the yield comfortably covers all expenses, including mortgage payments, while leaving a positive monthly cash flow.

Can Rental Yields Be Negative?

Yes, and it is a significant warning sign. A negative net yield means your annual operating costs—mortgage interest, maintenance, insurance, and fees—exceed the rental income.

In this situation, you must contribute your own funds each month to subsidise the property. While an investor might tolerate this for a short period in a market with rapid capital appreciation, it is not a viable long-term strategy for wealth creation.

A negative rental yield is a clear indicator that the asset is not financially self-sufficient. It signals that you must renegotiate the purchase price, reduce costs, or walk away from the deal.

Does Capital Growth Affect Rental Yield?

Capital growth—the increase in a property’s value over time—is not part of the rental yield calculation itself. Yield is purely a measure of income relative to price.

However, the two metrics often have an inverse relationship:

- High Capital Growth Areas: In prime locations like central London, property prices tend to rise much faster than rents. This has the effect of compressing or lowering rental yields.

- High Yield Areas: Conversely, regions with more modest price growth, such as some cities in the north of England, often deliver stronger rental yields.

A sound investment strategy involves balancing the immediate cash flow from yield with the long-term wealth creation potential of capital growth.

At World Property Investor, we provide the in-depth guides and market analysis you need to make informed decisions. Explore our resources to compare global property markets and find your next investment with confidence. Learn more at https://www.worldpropertyinvestor.com.