The Portugal Golden Visa is one of Europe’s most established residency-by-investment programmes, offering a five-year pathway to permanent residency and an EU passport for non-EU citizens. Although its renowned direct property investment route closed in October 2023, the scheme remains a highly effective tool for global investors seeking visa-free access across the 27-country Schengen Area.

This guide provides a clear, data-driven analysis of the programme's current structure, investment routes, and long-term benefits for the discerning global property investor.

What Is the Portugal Golden Visa Today?

For a global investor, the Portugal Golden Visa is best understood as a strategic five-year plan. It provides a mechanism to secure a European base, unlock significant personal mobility, and establish a clear route towards Portuguese—and therefore EU—citizenship. Its primary appeal has always been its flexibility, which is particularly advantageous for investors not prepared to relocate full-time.

The programme's core strength lies in its minimal physical presence requirement. Unlike many residency schemes demanding substantial in-country time, the Golden Visa requires an average of only seven days per year in Portugal. This allows investors to maintain their primary business and personal commitments elsewhere while securing a foothold in one of Europe’s most stable economies.

The following is a summary of the programme's current offerings.

Portugal Golden Visa Key Features At A Glance

This table outlines the essential components of the Portugal Golden Visa, enabling investors to quickly assess its primary benefits and obligations.

| Feature | Description |

|---|---|

| Residency Permit | A five-year residency permit, renewable every two years. |

| Schengen Area Access | Visa-free travel throughout the 27-country Schengen zone. |

| Minimal Stay | An average of only 7 days per year required in Portugal. |

| Family Inclusion | Extends to spouse, dependent children, and dependent parents. |

| Path to Citizenship | Eligibility for permanent residency and citizenship after 5 years. |

| Investment Focus | Primarily investment funds, job creation, or cultural donations. |

This structure positions the Golden Visa as one of the most efficient routes to an EU passport for investors who prioritise time and global mobility.

The End of Direct Property Investment

The most significant recent change is the closure of the direct real estate investment route for new applicants. The Portuguese government implemented this change to redirect investment capital away from the property market and towards other sectors of the economy.

This has fundamentally altered the investment strategy. Instead of focusing on real estate assets, investors must now explore alternative paths that support Portugal’s economic and cultural sectors. The programme has pivoted, making it more suitable for investors focused on:

- Portfolio Diversification: Gaining exposure to European venture capital or private equity through regulated investment funds.

- Cultural & Scientific Support: Backing Portugal's heritage or research through structured, non-refundable contributions.

- Entrepreneurship: Creating jobs by establishing a new business or investing in an existing Portuguese company.

Takeaway: The Portugal Golden Visa is no longer a vehicle for acquiring a holiday home but a strategic asset for securing global mobility, family security, and long-term planning, culminating in a powerful EU passport.

This shift demands a different form of due diligence. While the principles of investing in overseas property provide a solid foundation, the Golden Visa now requires a robust understanding of financial funds and alternative assets. The journey begins by acknowledging that while the path has changed, the destination—a secure future in Europe—remains as valuable as ever.

Choosing Your Investment Route

With direct property investment no longer an option for the Portugal Golden Visa, the landscape has shifted. Investors must now focus on contributing to Portugal’s economic and cultural fabric rather than acquiring tangible real estate assets. This change necessitates a move from a familiar asset class to more strategic options like regulated funds and philanthropic donations.

The new framework is designed to channel capital into dynamic sectors of the Portuguese economy. For a strategic global investor, this represents an opportunity to diversify a portfolio while securing residency in Europe. Each route possesses distinct characteristics, risk profiles, and potential returns, making a thorough evaluation an essential first step.

The Investment Fund Route: The Primary Choice

The most common option for new applicants is the €500,000 subscription into a qualifying Portuguese investment fund. This has become the default path, offering a structured, professionally managed, and relatively passive method of meeting the Golden Visa requirements.

These are not standard retail funds but venture capital (VC) or private equity (PE) funds, regulated by the Portuguese Securities Market Commission (CMVM). Their mandate is to invest at least 60% of their capital into companies headquartered in Portugal, thereby fuelling local enterprise and innovation.

To comply with visa regulations, the investment must be held for a minimum of five years. It is important to note that the fund itself may have a longer lifecycle, often between eight and ten years.

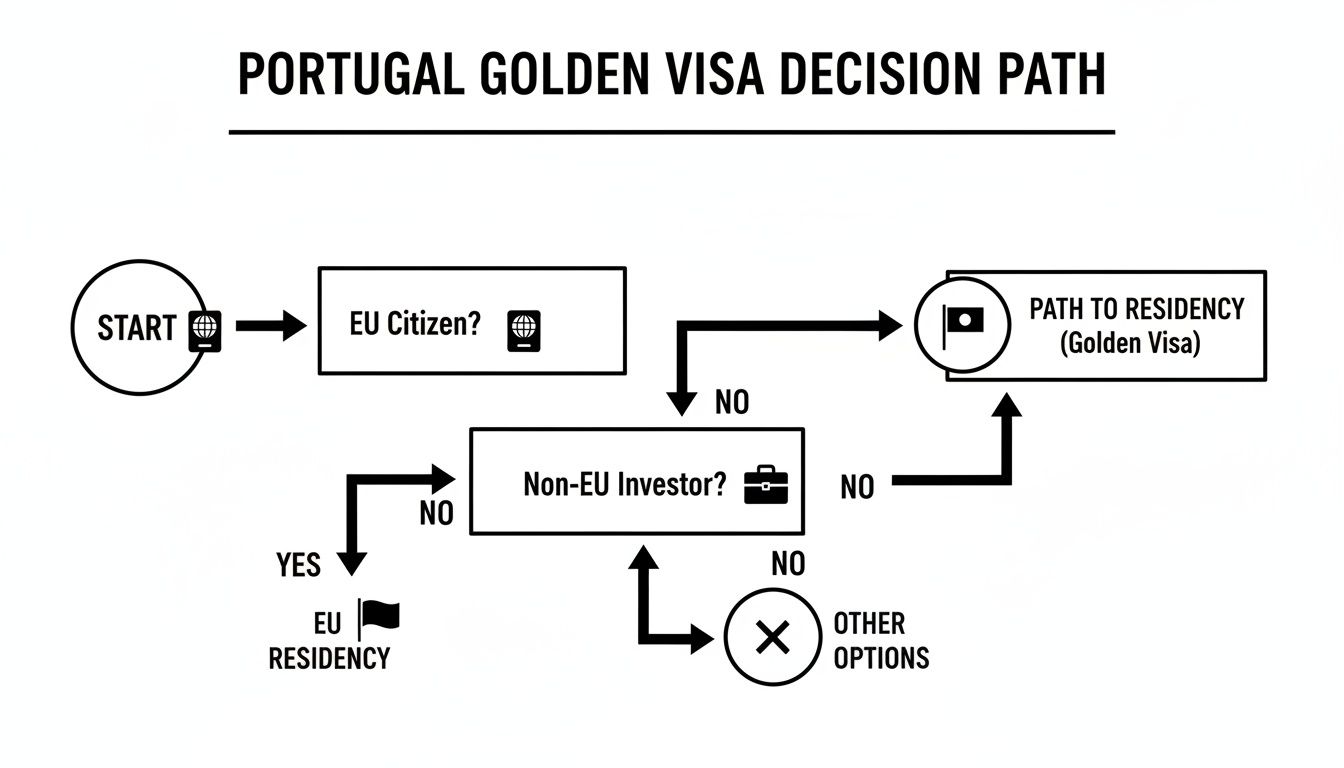

This simple flowchart helps clarify who the programme is for.

The Golden Visa is specifically structured as a residency pathway for non-EU investors.

Philanthropic and Cultural Contributions

For investors motivated by legacy and impact alongside financial objectives, Portugal offers routes that support its cultural and scientific heritage. These are structured as non-refundable donations—a direct contribution to the nation's future.

- Supporting the Arts & National Heritage: A donation of at least €250,000 to approved projects supporting artistic production or the maintenance of Portugal’s national cultural heritage.

- Scientific Research Investment: A contribution of €500,000 to public or private scientific research institutions within the national scientific and technological system.

The cultural donation route represents the lowest capital outlay for the Golden Visa, making it a compelling choice for philanthropically minded individuals. The return on this investment is the preservation of Portuguese identity, not financial gain. The government, via its cultural evaluation office (GEPAC), pre-approves eligible projects. While the real estate route has closed, understanding property market fundamentals remains valuable; our guide on the pros and cons of buying off-plan properties offers broader insights.

Job Creation and Business Investment

The most hands-on options involve direct investment into the Portuguese business sector, appealing to entrepreneurs seeking to establish a commercial footprint in Europe.

Two main pathways exist:

- Create 10 New Jobs: Establish a company in Portugal and create a minimum of 10 full-time jobs for Portuguese nationals. No minimum capital investment is specified, but operational costs are substantial.

- Invest in an Existing Business: Invest €500,000 into an existing Portuguese-registered company. The business must then create or maintain at least five full-time jobs for a minimum of three years.

Market Insight: This strategic shift has not diminished interest, particularly among UK investors. According to Portuguese government data, by 2023, 27,080 UK citizens held Portuguese residence permits, using the visa to restore EU mobility post-Brexit. The investment fund route alone generated over €260 million between 2019 and early 2024, confirming its role as the new cornerstone of the programme.

Ultimately, selecting the right path depends on your personal and financial objectives. A passive investor will find the fund route a natural fit, while an entrepreneur may prefer the job creation option. For those wishing to make a lasting, non-financial contribution, the cultural donation path offers a unique opportunity.

Navigating the Application Step by Step

The Portugal Golden Visa application is a series of methodical stages requiring precision and patience. Breaking the process down reveals a clear path from initial preparation to receiving the final residency card.

The entire process for any non-EU applicant rests on two fundamental pillars: a clean criminal record and proof that investment funds originate from a legitimate source outside of Portugal. Satisfying these two conditions establishes a solid foundation for the application.

Laying the Groundwork in Portugal

Before submitting the main application, several essential administrative tasks must be completed in Portugal. These steps are non-negotiable and are crucial for a smooth process.

Obtain a Portuguese Tax Number (NIF): The Número de Identificação Fiscal is a unique tax ID required for nearly all financial transactions, from opening a bank account to making the investment. This can often be arranged remotely through legal representatives.

Open a Portuguese Bank Account: The investment capital must be transferred from an international account into a Portuguese bank account held in the applicant's name. This provides the authorities with a clear audit trail of the funds.

Execute the Chosen Investment: Once funds are in the Portuguese account, the investment can be made. Whether subscribing to a €500,000 investment fund or making a €250,000 cultural donation, the transaction must be completed and officially documented before the application can proceed.

The Formal Application and Approval Stages

With the investment finalised and documented, the formal submission to AIMA (the Agency for Integration, Migration, and Asylum), the government body managing Portuguese immigration, can begin.

The process follows a specific sequence:

- Online Application Submission: A lawyer compiles and submits the application and all supporting documents via AIMA’s online portal. This includes proof of investment, personal identification, criminal record checks, and valid health insurance.

- Biometrics Appointment: Following an initial review, AIMA schedules a biometrics appointment for the applicant and any dependents. This involves providing fingerprints and a photograph in person in Portugal. Securing this appointment can often be the most time-consuming part of the process.

- Final Review and Approval: After the biometrics appointment, AIMA conducts its final due diligence. Once all requirements for the Portugal Golden Visa are verified, the application is formally approved.

- Issuance of Residency Cards: Following approval and payment of final government fees, the residency cards are issued. These cards are typically valid for two years.

Actionable Insight: It is critical to manage timeline expectations. Due to high demand and administrative backlogs, investors should realistically budget for the entire process—from submission to receiving the first residency card—to take 18 to 24 months. Engaging experienced legal counsel is essential to avoid common errors that can cause further delays.

Understanding how to structure finances is also key. For more on this, our detailed guide on financing an investment property provides transferable insights. A methodical approach ensures all requirements are met correctly, paving the way for a successful outcome.

Understanding the True Cost of Your Investment

A prudent approach to the Portugal Golden Visa requires looking beyond the headline investment figure. To budget effectively, investors need a complete picture of all associated government, legal, and recurring fees.

Failing to account for these ancillary expenses is a common pitfall that can lead to unforeseen financial commitments. The total outlay includes not only the investment capital but also one-time state fees, legal costs, and renewal charges for the main applicant and all dependents.

Government and Legal Fees

The Portuguese government imposes specific, non-refundable fees for processing Golden Visa applications. These are mandatory and apply to every family member included.

- Application Analysis Fee: Approximately €605 per applicant is due upon initial submission.

- Initial Issuance Fee: Upon approval, a fee of roughly €6,045 is required for each applicant to receive their first residence card.

In addition to official charges, legal fees must be factored in. Engaging a reputable Portuguese law firm is essential for navigating the complex bureaucracy. These costs typically range from €15,000 to €30,000 for a family, covering due diligence, document preparation, and final submission.

Renewal and Ongoing Costs

The financial commitments do not end upon receipt of the residency card. The Golden Visa requires renewal, and each renewal incurs fresh costs that must be included in any long-term budget.

The initial permit is valid for two years. At each renewal, further government fees are payable. The current renewal fee is 50% of the initial issuance cost, which amounts to approximately €3,023 per person. Smaller legal fees for managing each renewal cycle should also be anticipated.

Takeaway: It is crucial to distinguish between one-time and recurring costs. While the principal investment and initial legal fees are upfront, renewal fees for the entire family will arise every two years, directly impacting the overall return on investment over the five-year journey to citizenship.

A Practical Example: A Family of Four

To illustrate these costs, let's analyse the budget for a family of four—a main applicant, a spouse, and two children—applying via the €500,000 investment fund route.

The table below provides a realistic breakdown of expected first-year costs.

Estimated Costs For A Portugal Golden Visa Application (Family Of Four)

| Cost Item | Main Applicant (€) | Per Dependant (€) | Total Example (€) |

|---|---|---|---|

| Investment Capital | 500,000 | N/A | 500,000 |

| Application Fee | 605 | 1,815 (for 3) | 2,420 |

| Issuance Fee | 6,045 | 18,135 (for 3) | 24,180 |

| Legal Fees (Estimate) | 20,000 (for the family) | N/A | 20,000 |

| Subtotal (Year 1) | – | – | €546,600 |

This example shows that a €500,000 investment translates to an initial outlay exceeding €546,000. Investors must also factor in potential taxes on any income or capital gains from their fund. You can learn more in our guide to understand property taxes and other investment-related taxes. Budgeting for these additional layers from the outset ensures a transparent and predictable investment journey.

The Pathway from Residency to Citizenship

The Portugal Golden Visa should be viewed as a long-term strategic asset. Its true value for the global investor lies in the clear, structured pathway it offers from temporary resident to full Portuguese citizen, ultimately unlocking the rights and privileges of a European Union passport.

This pathway is underpinned by the programme’s famously flexible minimum stay requirement. Unlike other schemes demanding significant time in-country, the Golden Visa requires an average of only seven days per year in Portugal. This makes it an ideal fit for investors who are not ready to relocate but wish to build a secure European base for their family’s future.

The Five-Year Journey to Citizenship

The process of converting a Golden Visa into Portuguese citizenship is a five-year commitment. The timeline begins on the date the first residency card is issued. From that point, the investor must maintain the qualifying investment and meet the minimum stay requirements for the full five-year period. Upon completion, they become eligible to apply for naturalisation.

This timeline is one of the most favourable in Europe. Many other EU nations require ten years or more of continuous, full-time residency before citizenship is considered. Portugal’s five-year route, combined with its minimal stay requirements, creates a remarkably efficient path to an EU passport.

Key Milestones on the Path

Navigating the five-year period involves meeting several clear milestones. These are not overly onerous but require planning and attention to detail.

- Maintaining Your Investment: The qualifying investment (e.g., the €500,000 fund subscription) must be held for the entire five-year duration.

- Meeting Stay Requirements: Proof of having spent at least 35 days in Portugal over the five years is required.

- Maintaining a Clean Record: A clean criminal record must be maintained in both Portugal and the country of origin.

- Passing the Language Test: Applicants for citizenship must demonstrate a basic command of Portuguese by passing an A2-level language test.

Takeaway: The A2 language test, known as CIPLE (Certificado Inicial de Português Língua Estrangeria), assesses basic communication skills. It focuses on understanding and using everyday expressions and is widely regarded as an achievable target for a dedicated applicant.

The Post-Brexit Advantage for UK Investors

For British investors, the Portugal Golden Visa has become an essential tool in a post-Brexit world. Following the loss of automatic freedom of movement across the EU, Portuguese citizenship offers a direct and legal route to restoring those rights, providing a significant advantage for business, travel, and legacy planning.

Official government data confirms this trend. Post-Brexit, the Portugal Golden Visa has become a top choice for UK investors, with British nationals now ranking among Portugal’s top 10 foreign resident communities. By early 2023, Portuguese authorities had issued 27,080 residence permits to UK citizens, underscoring the programme's appeal. For more detail, you can learn how UK citizens are using the Golden Visa.

This restored mobility means UK nationals with a Portuguese passport can once again live, work, study, or retire in any of the 27 EU member states without a visa. It effectively reverses the limitations imposed by Brexit, providing a level of freedom no longer available with a British passport alone. For the forward-thinking investor, this represents the ultimate long-term return on their Golden Visa investment.

Weighing the Risks and Alternatives

A comprehensive investment decision begins with a frank assessment of the risks. With the Portugal Golden Visa, these can be both political and financial. The abrupt closure of the real estate route demonstrated that programme rules can change with minimal warning.

The now-dominant investment fund route carries its own set of considerations, primarily market volatility. While these funds are regulated, their performance is not guaranteed, and capital is at risk. It is crucial to conduct thorough due diligence on fund managers, their investment strategies, and exit timelines, as returns are intrinsically linked to broader economic conditions.

Comparing European Golden Visa Programmes

To gain a complete perspective, it is useful to compare Portugal’s Golden Visa with its main European competitors. Each programme is structured differently and caters to varying investor priorities.

| Feature | Portugal | Spain | Greece |

|---|---|---|---|

| Min. Investment | €250,000 (Cultural) | €500,000 (Real Estate) | €250,000 (Real Estate) |

| Citizenship Path | 5 Years | 10 Years | 7 Years |

| Stay Requirement | 7 days/year (average) | None required | None required |

| Main Investment | Funds & Donations | Real Estate | Real Estate |

While Spain and Greece continue to offer a direct path via property, Portugal’s five-year timeline to citizenship and extremely low stay requirement remain significant differentiators. For many global investors, this flexibility is the decisive factor.

Exploring Alternative Portuguese Visas

The Golden Visa is not the only route to Portuguese residency. Depending on individual circumstances, an alternative visa may be a more suitable fit, particularly for those with a steady income from outside the country.

Alternative: The D7 Passive Income Visa is a strong alternative for individuals with reliable passive income, such as pensions, dividends, or rental earnings. It does not require a large upfront investment, but applicants must prove a consistent monthly income exceeding the Portuguese minimum wage. The main trade-off is the requirement to become a tax resident and spend a significant amount of time in Portugal each year.

The Golden Visa's sustained popularity highlights its unique market position. Since 2012, the programme has attracted €7.5 billion in foreign capital from nearly 40,000 approved applications, based on official Portuguese government statistics. You can find more detailed statistics on Golden Visa approvals and investment trends.

The right choice depends on your long-term objectives. For a fast track to an EU passport with minimal physical presence, the Golden Visa is difficult to surpass. However, for those prepared to relocate and who possess steady passive income, the D7 visa could be a more practical route. For a broader analysis of global options, see our guide on the best countries to invest in property.

Your Golden Visa Questions Answered

Exploring a residency programme of this nature inevitably raises many questions. To provide clarity, we have compiled straightforward answers to the most common queries from investors considering the Portugal Golden Visa.

Can I Still Buy Property For The Portugal Golden Visa?

No. As of October 2023, direct or indirect real estate investment no longer qualifies for the Portugal Golden Visa. This is the most significant recent change to the programme.

The government has shifted the programme’s focus away from property to channel capital into other economic sectors, such as regulated funds, cultural projects, and job creation.

How Long Does The Application Process Take?

Applicants should be prepared for a substantial waiting period. A realistic timeline, from submitting the application to receiving the first residency card, is between 18 and 24 months.

The primary cause of this delay is the high volume of applications being processed by AIMA, Portugal’s immigration agency. Engaging an experienced legal team is therefore non-negotiable; they can ensure the application file is complete and accurate from the outset, helping to avoid common errors that lead to frustrating delays.

Takeaway: A key benefit of the Portugal Golden Visa is its flexibility. The programme is structured for global citizens who require a European base and future citizenship options without the commitment of full-time relocation, making it a powerful tool for portfolio and lifestyle diversification.

Do I Have To Live In Portugal To Keep My Residency?

No. For most global investors, this is the programme’s most compelling feature. To maintain active residency status, an average of only seven days per year must be spent in Portugal.

This equates to just 14 days over each two-year renewal period, making it an ideal arrangement for investors seeking a pathway to EU citizenship without immediate plans to relocate.

Can My Family Join Me On The Golden Visa?

Yes. The Golden Visa is designed for families. As the main applicant, you can include your spouse or partner, dependent children, and the dependent parents of both you and your spouse.

This inclusive approach to family reunification is a primary reason the programme remains highly popular with international investors seeking long-term security and mobility for their entire family.

At World Property Investor, we provide the data-driven analysis you need to make confident decisions in global markets. Explore our in-depth guides and find your next investment opportunity today at https://www.worldpropertyinvestor.com.